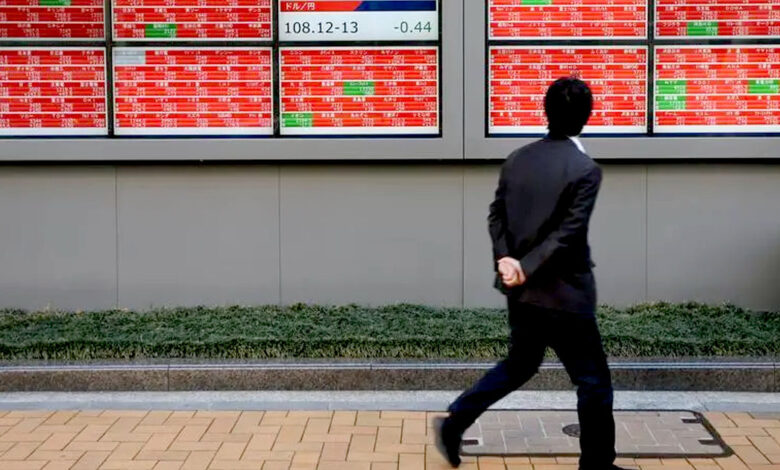

Asian Stocks Rally as Debt Ceiling Concerns Ease; Sony Drives Nikkei Higher

Asian Stock Markets Rise as Debt Ceiling Concerns Ease, Sony Boosts Nikkei

On Thursday, most Asian stock markets experienced gains, following the positive performance on Wall Street. Optimism grew regarding the resolution of the U.S. debt ceiling issue, while Japanese conglomerate Sony’s strong showing propelled the Nikkei index to a 20-month high.

The Nikkei index surged by 1.5%, primarily driven by a nearly 6% increase in Sony Corp’s shares (TYO:6758). Sony announced its consideration of spinning off and listing its financial services unit, a move that could occur within the next three years. The company further disclosed its intention to distribute shares of the new entity as a dividend.

Japan’s significant drop in trade deficit, surpassing expectations, also contributed to positive market sentiment. This aided the Nikkei in extending its winning streak for a sixth consecutive session. The index has outperformed its Asian counterparts this year, benefiting from strong corporate earnings, the resilience of the Japanese economy, and dovish signals from the Bank of Japan.

Broader Asian markets followed the upward trajectory, reflecting gains on Wall Street. The Biden Administration’s indication that a deal on raising the U.S. debt ceiling could be reached as early as this week eased concerns about a potential U.S. debt default, given the approaching June 1 deadline for policymakers to reach an agreement.

However, caution prevailed due to worries about slowing economic growth, particularly in China. China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rebounded, rising by 0.4% and 0.8%, respectively, after two consecutive days of losses following weak economic readings from the country. Recent data suggested a slowdown in China’s post-COVID economic recovery, posing challenges for Asian markets with significant trade exposure to the country.

Technology stocks also played a role in boosting Asian markets. Hong Kong’s Hang Seng index increased by 1.2%, supported by a 3.2% surge in shares of Alibaba Group Holding Ltd (HK:9988) (NYSE:BABA) ahead of its first-quarter earnings release. The stock was further buoyed by Michael Burry, known for his role in “The Big Short,” doubling his stake in the Chinese e-commerce giant. Burry believes the company will benefit from China’s reopening throughout this year.

Other technology-heavy indexes demonstrated positive movement, with South Korea’s KOSPI rising by 0.5% and Taiwan’s Weighted index gaining 1.1%.

Australia’s ASX 200 index added 0.5% after a labor market reading came in softer than expected. This raised hopes that the Reserve Bank will pause future interest rate hikes.