Restrictions on Chinese Gallium Supply Spark Concerns About Future Electric Vehicle Models

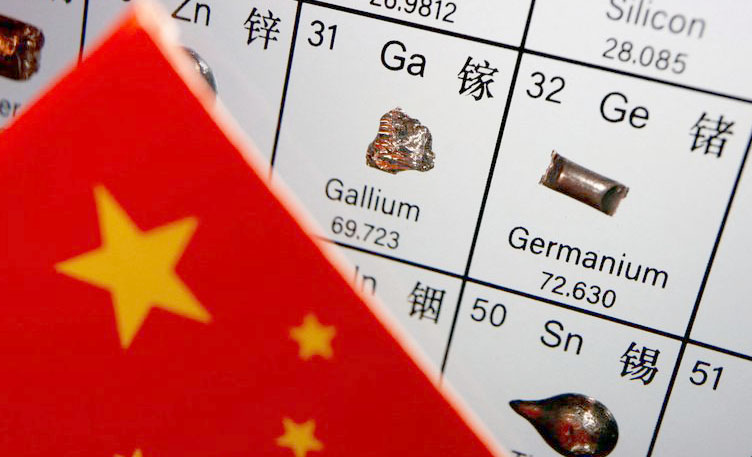

China’s crackdown on gallium exports has left automakers pondering whether they can rely on this metal that was once hailed as a game changer for electric vehicles (EVs).

Gallium may not be a household name, but it plays a crucial role in various applications, ranging from LEDs to compact phone chargers. In its pure form, gallium can even melt in your hand! However, its compounds have gained recognition for their use in semiconductors, making it a sought-after material.

Automakers are constantly searching for ways to enhance EV efficiency and reduce weight in order to lower costs. That’s where gallium nitride comes in. This semiconductor material achieves both objectives and is far more affordable than alternatives such as platinum or palladium.

Gallium is primarily sourced from trace amounts found in zinc ores and bauxite. When bauxite is processed to make aluminum, gallium metal is produced. An astonishing 80% of gallium comes from China, according to the Critical Raw Materials Alliance (CRMA), an industry association in Europe.

For EVs, gallium nitride, in particular, possesses the ability to handle high power without generating excessive heat. This makes it ideal for on-board chargers and potentially inverters, which regulate the flow of electricity to and from the battery pack.

Umesh Mishra, co-founder of Transphorm, a California-based company, hails gallium nitride as a game changer, stating, “Gallium nitride is a huge game multiplier.” Transphorm is working with automakers during the design phase to incorporate this compound into on-board chargers for a wide range of EV models expected to hit the market around 2026. Additionally, discussions are underway to explore its use in inverters.

Nevertheless, the recent decision by China to impose export controls on gallium, along with germanium, has raised concerns among mineral experts. These restrictions, set to commence next month, might compel automakers to reassess their strategies.

The automotive industry is still recovering from the global semiconductor shortage caused by the pandemic. This shortage forced automakers to halt production and even leave unfinished vehicles waiting for a single chip.

Alastair Neill, a director at the Critical Minerals Institute, warns that automakers in the early stages of designing their next-generation EVs may opt for silicon carbide instead of gallium nitride to avoid potential supply chain disruptions. Although silicon carbide performs about 30% worse than gallium nitride, it could be a safer choice.

Automakers have responded cautiously to China’s announcement, with many stating that they are closely monitoring the situation. A source from a Japanese automotive supplier revealed that they are currently weighing the pros and cons of gallium nitride and silicon carbide for their future power semiconductors.

Chipmakers, too, have been hesitant to comment. Germany’s Infineon, for instance, recently acquired Canada’s GaN Systems, citing the projected growth in gallium nitride chips but refrained from disclosing specific details.

Mishra from Transphorm remains confident that if China restricts gallium entirely, other countries will step in to fill the void. As gallium is produced during the aluminum-making process, he believes that alternative supply sources will emerge and alleviate any potential disruptions.

However, not everyone shares this optimism. Neill emphasizes the difficulty of replacing gallium nitride, stating, “People have to look for other options, but gallium nitride is hard to replace. Coming up with an alternative would take a lot of time.”

In conclusion, China’s gallium export controls have thrown automakers into a state of uncertainty. While some may consider shifting to silicon carbide, the industry’s reliance on gallium nitride and its unique properties make finding a suitable alternative a challenging task. Only time will tell how this situation unfolds and whether automakers can navigate the potential hurdles ahead.