Navigating a Precarious Crossroads: BIS Sounds Alarm on Global Economy’s Battle Against Inflation

The Bank for International Settlements (BIS), the world’s central bank umbrella body, issued a warning about the critical state of the global economy in its fight against inflation. Despite numerous interest rate hikes over the past 18 months, inflation remains stubbornly high in many major economies, and the resulting surge in borrowing costs has led to significant banking collapses reminiscent of the 2008 financial crisis.

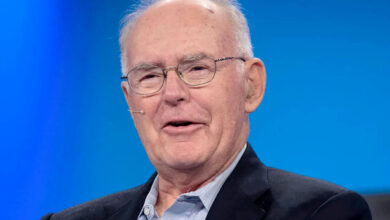

In its annual report, the BIS emphasized that the global economy is currently at a crucial juncture that demands immediate attention. Agustin Carstens, the BIS general manager, stated that the time for solely pursuing short-term growth has passed. Instead, monetary policy must prioritize restoring price stability, while fiscal policy should focus on consolidation.

Claudio Borio, the head of BIS’s monetary and economics unit, added that there is a risk of an inflationary psychology taking hold. However, the recent larger-than-expected interest rate hikes in Britain and Norway indicate that central banks are making efforts to address the problem.

These challenges are unprecedented in the post-World War II era, as a surge in inflation is now coexisting with widespread financial vulnerabilities across many parts of the world. The BIS report warns that if inflation remains elevated for an extended period, the necessary policy tightening measures will need to be stronger and more prolonged. Additionally, the report cautions that the banking sector may face further problems in light of these circumstances.

Borio stated that he believes central banks will be able to bring inflation under control since that is their primary mandate—to restore price stability. However, the question remains: what will be the cost?

The upcoming three-day forum in Sintra, Portugal, hosted by the European Central Bank, will gather top central bankers and policymakers to discuss these turbulent times. The BIS, based in Switzerland, held its own annual meeting recently, during which central bankers examined the challenges faced in the past few months. The failure of several U.S. regional banks, including Silicon Valley Bank, and the emergency rescue of Credit Suisse in Switzerland were notable events during this period.

Historical data presented in the BIS report indicates that approximately 15% of rate hike cycles result in severe stress in the banking system. However, this frequency increases significantly when interest rates rise, inflation surges, or house prices experience sharp increases. In some cases, the percentage can even reach 40% if the private debt-to-GDP ratio is in the top quartile at the time of the first rate hike. Given the current scenario of high debt levels, a global inflation surge, and substantial increases in house prices, all these factors align to create a precarious situation.

The BIS report also estimates that supporting aging populations will impose a cost of approximately 4% to 5% of GDP in advanced and emerging market economies over the next two decades. Without governments tightening their belts, this could push debt levels above 200% and 150% of GDP by 2050 in advanced and emerging market economies, respectively, and potentially even higher if economic growth rates decline.

Furthermore, the BIS report proposes an evolved financial system that incorporates central bank digital currencies and tokenized banking assets to expedite and enhance transactions and global trade. This blueprint represents a potential game-changer for the financial landscape.

Commenting on the current economic situation, Carstens, the former head of Mexico’s central bank, stressed the need for policymakers to take action. He emphasized the necessity of correcting unrealistic expectations that emerged after the Great Financial Crisis and the COVID-19 pandemic regarding the extent and duration of monetary and fiscal support.

The BIS believes that achieving a soft or soft-ish landing—an increase in rates without triggering recessions or major banking crises—is still possible. However, the situation is undeniably challenging.