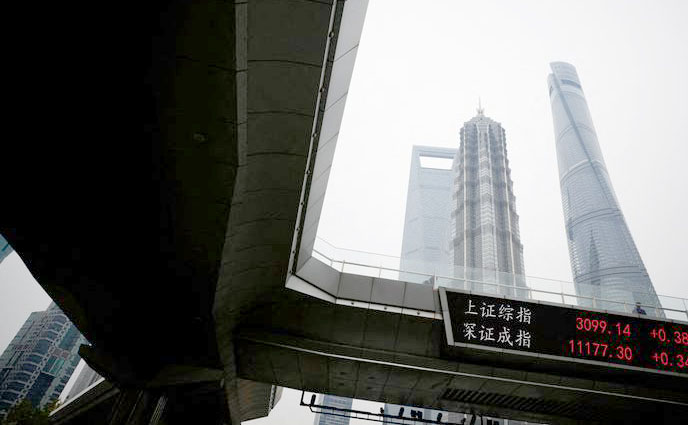

Marketmind: China’s Lackluster Data Leaves Investors Hungry for Stimulus

Let’s take a peek at what’s on the horizon for European and global markets, brought to you by Wayne Cole.

Well, China’s data dump today wasn’t exactly a thrill ride. The Q2 GDP number squeaked by at +0.8% q/q, just managing to exceed expectations. However, on a year-on-year basis, it fell short at 6.3%, implying some revisions to the past.

In June, industrial output outperformed expectations, rising by 4.4% compared to last year. However, retail sales were a disappointment at 3.1%, and property sales took a nosedive, marking the largest monthly drop this year. So, it’s safe to say we’ve got a mixed bag of results.

Unsurprisingly, the market responded with dissatisfaction, causing Chinese shares to drop and the yuan to weaken. The Aussie dollar, the investors’ beloved liquid China proxy, found itself slightly submerged, as analysts suspect Beijing might allow the yuan to continue depreciating as a means of indirect stimulus.

This data underscores the pressing need for substantial fiscal spending. However, Beijing doesn’t seem too eager to fulfill the market’s desires this time around. The central bank kept one-year rates unchanged on Monday, and analysts have resigned themselves to waiting for a Politburo meeting later this month for any fresh steps.

Meanwhile, it’s the season for earnings reports, and on Wednesday, Tesla (NASDAQ:TSLA) will be the first of the tech giants to step up to the plate. The stakes are high, and everyone’s curious to see if they can live up to the lofty expectations.

According to BofA, not only Tesla but also the other six tech behemoths are expected to boast an average earnings growth of 19% over the next 12 months, surpassing the estimated 8% growth for the rest of the S&P 500.

It’s worth noting that the astounding surge in the market capitalization of these seven giants will trigger a re-weighting of the Nasdaq on July 24. As a result, their weighting will decrease from 56% to 44% of the index. Apple (NASDAQ:AAPL) will see a drop of around 4 percentage points to 12%, while Microsoft (NASDAQ:MSFT) will experience the same decrease to 10%.

Goldman Sachs predicts that passive funds tracking the NDX will rebalance their portfolios, but based on the 2011 special rebalance experience, the impact on individual stocks should be minimal.

Let’s keep an eye on key developments that could sway the markets on Monday:

- ECB Board member Fabio Panetta attending the G20 Finance Ministers and Central Bank Governors meeting in Gandhinagar, India

- ECB President Christine Lagarde delivering a pre-recorded speech, accompanied by board members Frank Elderson and Philip R. Lane at the 9th ECB conference on central, eastern, and south-eastern European (CESEE) countries

- The Federal Reserve Bank of New York releasing the Empire State Manufacturing Survey for July

(By Wayne Cole; Edited by Jacqueline Wong)