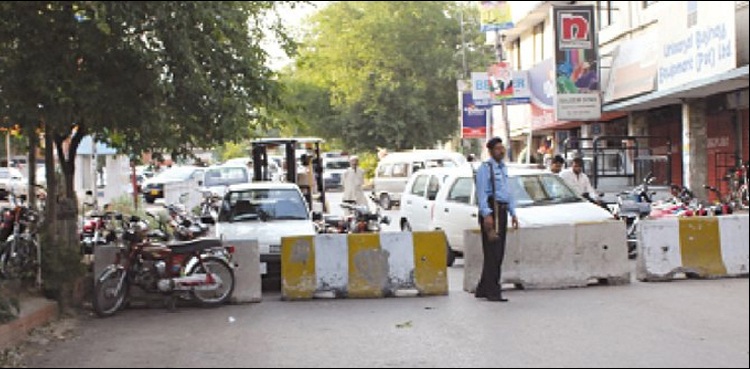

ISLAMABAD: Authorities in Islamabad on Wednesday imposed serious measures to curb the spread of coronavirus after an increase in the number of cases in the city. On Tuesday, the Islamabad Regional Magistrate announced the closure of the entire market, shopping malls, restaurants and private offices in the city.

However, soup kitchens and shelters for the poor will remain active in the city, the order stated. Authorities will also set up savings accounts for the poor and needy, he added. As with other parts of the country, essential services including hospitals, utilities, banks and grocery stores are allowed to operate, the order is drawn.