Global Stock Market Momentum Pauses Following Significant Gains, Amidst an Active Week for Central Banks

Global Stock Market Momentum Pauses Following Impressive Rally, Amidst a Busy Week for Central Banks

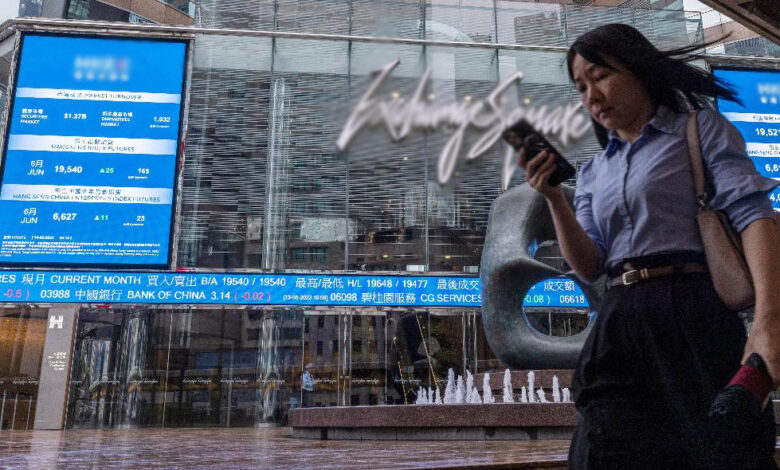

The global stock market experienced a brief pause on Friday after reaching 14-month highs, while the U.S. dollar faced its largest weekly decline since January, following a week filled with significant central bank meetings worldwide.

The MSCI All-World index saw a marginal decline of 0.06% but remained close to its highest level since April 2022. Although Wall Street’s main equity indexes ended the day lower, they still recorded solid weekly gains.

After a week filled with central bank actions, the Bank of Japan chose to maintain its ultra-easy monetary policy on Friday, despite higher-than-expected inflation. Earlier in the week, the Federal Reserve decided to keep interest rates unchanged but hinted at potential future hikes later in the year, while the European Central Bank raised rates by a quarter-point.

“We have had a fairly positive week,” said Art Hogan, chief market strategist at B Riley Wealth. “The ECB and the UK are likely still in the process of tightening, whereas the U.S. is nearing the end of its rate hiking cycle, and I think that has been driving some divergences.”

On Wall Street, the Dow Jones Industrial Average fell 108.94 points or 0.32% to 34,299.12, the S&P 500 lost 16.24 points or 0.37% to 4,409.6, and the Nasdaq Composite dropped 93.25 points or 0.68% to 13,689.57.

In Europe, the pan-European STOXX 600 index rose by 0.5%, while Japan’s Nikkei saw a 0.7% increase, marking its 10th consecutive week of gains.

In currency markets, the dollar index, which measures the greenback against a basket of currencies, rose by 0.18%, with the euro down 0.09% at $1.09. However, the dollar was on track for its largest weekly percentage decline since mid-January.

Meanwhile, the yen reached its lowest point against the euro in 15 years following the Bank of Japan’s decision. The Japanese currency also weakened by 1.07% against the greenback, reaching 141.84 per dollar, a six-month low.

“The yen is facing a significant negative yield gap compared to other G10 currencies,” said Vassili Serebriakov, FX strategist at UBS in New York.

U.S. Treasury yields rose, with the benchmark 10-year yield increasing after two consecutive days of decline, as comments from Fed officials indicated that the central bank was not yet finished with its interest rate hikes.

Fed Governor Christopher Waller stated at an economics conference that core inflation “is not coming down like I thought it would,” suggesting that further tightening might be necessary.

Benchmark 10-year notes increased by 4 basis points to 3.77% from 3.73% on Thursday.

Oil prices rose and recorded weekly gains, driven by higher Chinese demand and supply cuts from OPEC+.

U.S. crude settled up 1.6% at $71.78 per barrel, while Brent settled at $76.61, up 1.2% for the day.