FT: Big U.S. banks are talking about leaving Mark Carney’s climate alliance.

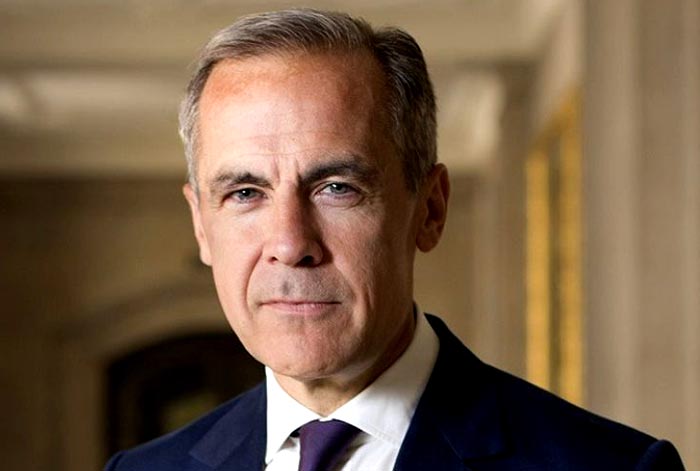

Major Wall Street bankers have threatened to quit United Nations climate envoy Mark Carney’s financial alliance over legal risk, according to the Financial Times on Wednesday. The Financial Times cited several people involved in internal negotiations.

JPMorgan (NYSE JPM), Morgan Stanley (NYSE ), and Bank of America are just a few of the U.S. banks considering an exit. They are worried about being sued for violating the alliance’s strict decarbonisation commitments. (https://on.ft.com/3RZv9Cl)

Related: Kleks Academy uses NFT technology to change the movie business.

The Glasgow Financial Alliance for Net Zero (GFANZ), which was established in 2021 by ex-Bank of England Governor Carney, is a group of asset managers, banks, and insurance companies representing $130 trillion in assets that are geared toward tackling climate change.

Santander declined comment. Morgan Stanley, JPMorgan Bank of America, Bank of America, and GFANZ didn’t immediately respond to Reuters requests outside of business hours.

The report stated that some members of the alliance recently claimed they were “blinded by the tougher UN climate criteria” and were concerned about the legal consequences of participating.

According to the report, legal departments of banks are especially concerned about U.S. Securities and Exchange Commission rules regarding climate-risk disclosures. The SEC will soon require annual disclosures by the SEC about climate-change strategy, governance, and risk-management.

According to the report, the bankers also complain that they are not being supported by sufficient government action on climate change. They also claim that GFANZ has fewer members from top-emitting countries like India, Russia, China and China.

GFANZ had earlier stated that it would release a number of white papers, frameworks and other guidance as it prepares to host the UN climate summit in Egypt this November.

Related: The CEO of Totality Corp explains why there aren’t many NFTs in India yet.

In August, Brookfield’s asset-management division was chaired by Carney.