Chinese Med Firms Hit the Brakes on Going Public Amid Graft Probes

SHANGHAI – Hold the phone! More and more healthcare honchos in China are putting a pin in their plans to go public. Why, you ask? It seems the stock market bigwigs are keeping a closer eye on those pill producers, especially with all the anti-corruption fuss ramping up.

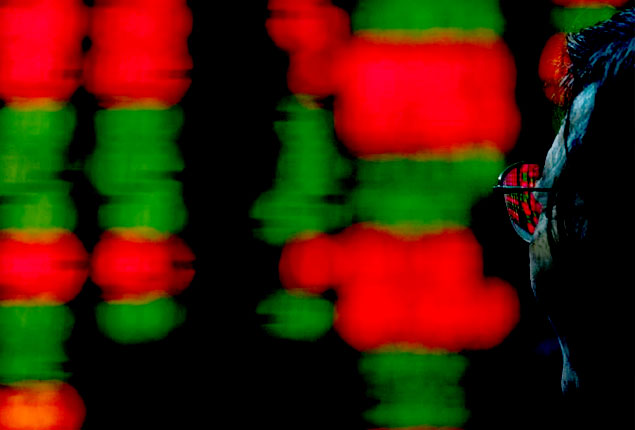

Since July, China’s health stocks took a nosedive. Word on the street is, the big guns up top launched a campaign to weed out the shady business of, get this, slipping doctors some extra cash for pushing certain meds and gadgets.

You’d think after China jazzed up its system for public listings, things would be smoother. But nope! Medicine makers are still under the microscope. It’s like every move they make, every bond they break, someone’s watching them.

Case in point, Shanghai Rongsheng Biotech Co pulled the plug on their big public debut this week. Why? They were spending a bit too much on sales, raising a few eyebrows. The local stock exchange dropped them a note, basically asking, “What’s the deal with your expenses, buddy?”

A banker in the know, who’d rather stay anonymous (can’t blame him), said, “The spotlight’s on the medicine folks. These days, getting the green light for going public? Tougher than a two-dollar steak.”

Another pill producer, Fujian Mindong, hit the brakes too. The exchange wanted the low-down on their sales jigs and conferences. And get this, they were shelling out almost half their earnings on sales!

Another banker chimed in, saying companies are getting cold feet with their public debut plans. “They’re getting grilled about every penny spent on sales,” he whispered.

Reaching out to Rongsheng and Fujian Mindong for a little chit-chat? Dead end. They played the silent game. But hey, they did holler back at the stock exchanges, claiming all’s good in the hood with their sales.

Here’s a zinger: this year, a whopping 12 healthcare companies have hung up their public debut dreams. And only 14 have made the leap, compared to double that number last year.

And it’s not just the med world feeling the heat. From tutors to tech wizards to the property pros, China’s crackdown has everyone sweating bullets, costing them big bucks.

As for those already in the public market? Their stocks are plummeting, and the ripple effects? Oh boy! The anti-corruption wave could spell trouble for their cash registers.

And hold onto your hats, because this crackdown ain’t kid’s play. 168 hospital bigwigs are in the hot seat, suspected of playing dirty. That’s twice as many as last year! Plus, 10 medical meet-ups got postponed last month. Rumor has it, some of these gatherings are more about greasing palms than genuine learning.

One insider, keeping things on the down-low, said, “This crackdown’s on steroids! It’s making waves everywhere, and sales? They’re in for a bumpy ride.”