Asia Waits with Bated Breath: Nvidia’s Big Reveal & Yields Sky-High

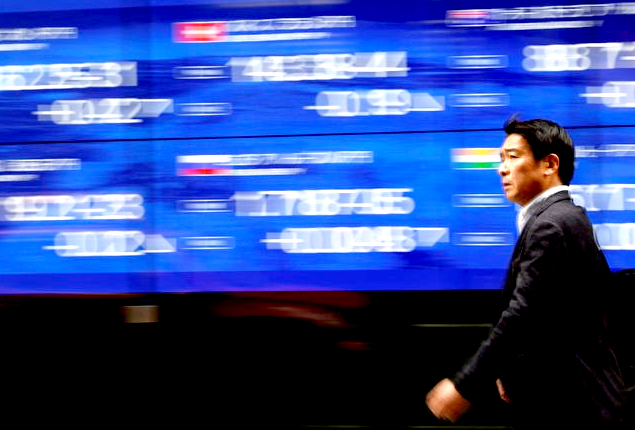

SYDNEY – It’s all eyes on Asia today! Market watchers are, quite literally, holding their breath as they wait on the edge of their seats for Nvidia’s (NASDAQ:NVDA) big reveal. Why, you ask? Well, folks want to know if those sky-high valuations in the tech sector can handle the heat from rising bond yields. And, to throw a bit of a damper on things, Japan’s factory numbers have been, well, a tad depressing, making everyone a smidge jittery.

Europe? Oh, they’re playing it cool as a cucumber. EUROSTOXX 50 futures nudged up by just 0.2%. Across the pond, S&P 500 futures inched up by 0.3%, and Nasdaq futures went up a smidgeon more at 0.4%.

Back in Asia, MSCI’s main index for Asia-Pacific shares (excluding Japan) rose by 0.3%, not straying too far from a recent low. The Nikkei in Japan? They managed a teeny-tiny 0.3% rise. Go, Japan!

Now, here’s the kicker: Japan’s factories took a hit for the third month straight in August. Ouch! But hey, keep your ears open for the US’s PMI readings today. Rumor has it, things are still a tad rocky over there.

The benchmark 10-year Japanese bond yield? Whew, it soared to an almost decade-high of 0.675%. Looks like the Bank of Japan sitting on their hands meant the go-ahead for some serious bond-selling.

China’s scene was a mixed bag. Those blue-chips? Yeah, they slipped 0.9%, undoing their gains from the day before. But look at Hong Kong’s Hang Seng Index – up by a cool 0.6% after leaping by 1%. Not too shabby!

And in the ‘what’s hot’ department – iron ore prices surged by 5%, and coking coal & coke prices jumped more than 3%. Why? Well, it seems the Chinese government is playing coy about steel production cuts.

Now, back to Nvidia. The anticipation is palpable! Their last quarterly report set the tech world ablaze, pushing the S&P 500 way up. And let me tell you, folks are buzzing about Nvidia shares hitting a whopping $481.87. Word on the street is, traders are expecting some wild moves post-results.

And the predictions? Some say Nvidia might reveal a mind-blowing 110% growth, shooting their revenue up to a cool $12.50 billion. Stuart Humphrey from JPMorgan whispered some even wilder numbers – think $14-15 billion. Stuart mused, “That might be a stretch, but hey, even if it’s close, those shares are gonna fly!”

Meanwhile, Wall Street had a bit of a wobble with yields at a 16-year peak. The Dow Jones dipped 0.5%, and the S&P 500 slipped 0.3%. Only the Nasdaq Composite managed to pull up by 0.1%.

Financial stocks? Oh boy, they had a tough time. The S&P 500 banks plunged 2.4% after both S&P and Moody’s threw some shade with downgrades.

In other news, Treasuries are catching their breath after a wild ride. Ten-year yields took a slight dip to 4.3062% in Asia, right after they touched a 16-year high. Now, with Fitch’s recent credit downgrade and chatter about China possibly offloading Treasuries, investors are eagerly awaiting the Fed’s Jackson Hole summit for some guidance.

And, drumroll please, Richmond Fed President Thomas Barkin’s comments have everyone wondering if Chair Jerome Powell will drop some major hints after the US’s recent economic upswing.

On the currency front, things are chill ahead of Jackson Hole. The US dollar is standing tall and mighty, while the yen edged up 0.2% amidst whispers about Japan’s next moves.

And if you’re an oil buff, you’re in luck! Brent crude futures and U.S. West Texas Intermediate crude both ticked up by 0.1%. Oh, and for you gold enthusiasts, spot gold shone a bit brighter at $1,902.68 per ounce.

There you have it, folks! Stay tuned, ’cause things are heating up in the world of finance!