Asia Shares Inch Up Amid Cautious Outlook on US Banking Data

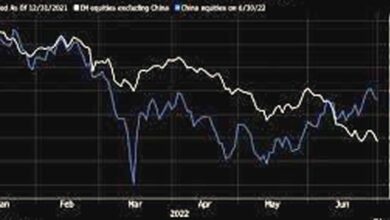

On Monday, Asian markets showed cautious optimism as investors waited for the release of U.S. inflation data. The previous week’s strong payrolls report had dashed hopes of a rate cut, and a positive surprise on consumer prices would further challenge those bets.

Forecasts are for a rise of 0.4% in April for both the headline and core CPI, with the annual pace of core inflation slowing just a tick to 5.5%. Additionally, the Federal Reserve’s survey of loan officers due later in the day will be closely watched to determine the impact of regional banking stress on lending.

Bruce Kasman, head of economic research at JPMorgan, predicted that the survey would show “further broad-based tightening in bank lending standards,” increasing concern about a disruptive financial market event on the horizon. Despite this, MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.7%, while Japanese markets fell 0.6%.

Chinese blue chips gained 1.1%, and Euro Stoxx 50 futures added 0.1%, while FTSE futures were closed for a holiday. S&P 500 futures and Nasdaq futures were both little changed. The U.S. two-year yields were up at 3.93% after briefly dipping to 3.657% last week. The risk of a U.S. government default also weighed on bond markets. U.S.

Treasury Secretary Janet Yellen warned of a possible crisis if Congress does not raise the debt ceiling. The market implied a near 90% chance that the Fed would keep rates steady at its next meeting in June, and a 75% probability of a cut in September. Gold was holding at $2,021 an ounce, and oil prices rose slightly, with Brent up 40 cents at $75.70 a barrel and U.S. crude up 42 cents to $71.76 per barrel.