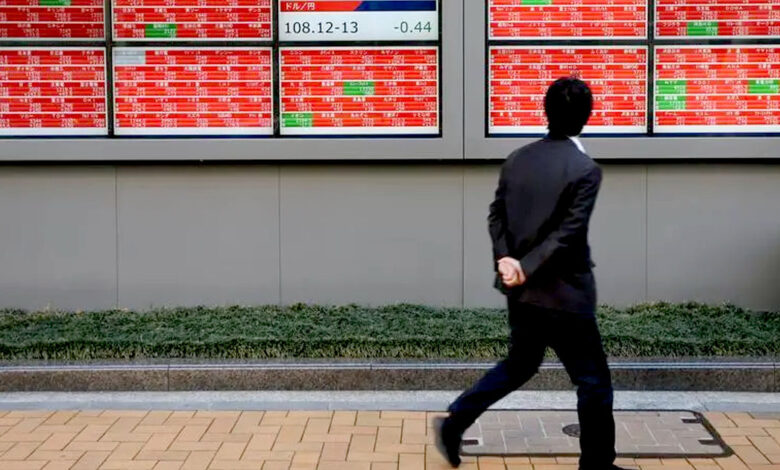

Asia-Pacific Stocks Surge as Rate Hike Fears Ease and Debt Bill Clears House

In a positive turn of events, most Asia-Pacific stock markets experienced gains on Thursday, driven by diminishing expectations of an imminent U.S. interest rate hike and relief over the successful passage of a bill in the U.S. House of Representatives to suspend the federal debt ceiling. Adding to the optimistic sentiment was the unexpected growth in Chinese factory activity—a rare positive sign for the country’s post-pandemic recovery. Additionally, crude oil prices rebounded from a four-week low.

The U.S. dollar weakened against the yen, reaching a one-week low and remaining close to a more-than-two-month low against the euro, following comments from Federal Reserve officials, including governor and vice chair nominee Philip Jefferson, hinting at a potential skip in rate hikes during the upcoming June 13-14 policy meeting. Meanwhile, Treasury yields inched up from a nearly two-week low.

MSCI’s broadest index of Asia-Pacific shares experienced a notable rebound, gaining 0.82% after reaching its lowest level since March 22 in the previous session. Japan’s Nikkei rose by 0.77%, while Hong Kong’s Hang Seng and mainland Chinese blue chips advanced by 1.07% and 0.71% respectively.

Furthermore, U.S. S&P 500 e-Mini futures saw a modest increase of 0.12%.

The House of Representatives, divided yet supported by both Democrats and Republicans, successfully passed a bill to suspend the $31.4 trillion debt ceiling, thereby averting a catastrophic default. This development instilled optimism that the bill would smoothly progress through the Senate before the weekend.

Ray Attrill, Head of Foreign-Exchange Strategy at National Australia Bank, expressed confidence in the bill’s progression, stating, “This has gone through with a very big majority, so there’s enough bipartisan support that it’s very hard to believe this isn’t going to be even more of a formality in the Senate.” Attrill added that the focus would now shift towards incoming data and the upcoming Fed meeting.

Currently, money markets estimate around a 38% likelihood of a rate hike from the Federal Reserve on June 14, significantly down from approximately 70% earlier in the day after unexpectedly strong job numbers were released. However, the sentiment shifted when the Fed’s Jefferson suggested that skipping a rate hike in two weeks would allow policymakers more time to assess additional data before making a decision. Philadelphia Fed President Patrick Harker also expressed his inclination to support a pause in rate hikes.

Attention will be closely drawn to employment data scheduled for release later this week, including the ADP survey and the monthly non-farm payrolls report on Friday.

Tony Sycamore, a market analyst at IG Markets, noted the market’s retracement in expectations for the June meeting, stating, “It’s been a fairly strong retracement in terms of the market’s expectations for the June meeting, and it’s come contrary to the data.” Sycamore expressed some skepticism about a complete hold, suggesting that the odds are closer to 50/50.

The U.S. dollar slipped to its lowest level since May 25 against the yen early in the Asian session but rebounded by 0.24%, reaching 139.655 yen by the European morning. The euro slightly weakened by 0.08% to $1.06785, approaching Wednesday’s low at $1.0635, a level last seen on March 20.

In the bond market, benchmark 10-year U.S. Treasury yields edged up to 3.6733% in Tokyo after hitting 3.6140% overnight, the lowest level since May 18.

As for oil prices, Brent crude futures for August delivery rose by