Unveiling the Mega Merger: Credit Suisse’s Turmoil and UBS’s Swift Intervention

The mega merger between UBS Group and Credit Suisse has reached its culmination, solidifying its status as the largest banking deal since the global financial crisis. This orchestrated acquisition, mandated by Swiss authorities as a measure to avert a wider banking catastrophe, now bears the official seal of approval as of Monday.

For Credit Suisse, a venerable institution with a 167-year history, this represents the closing of its final chapter. Years of scandal and missteps have eroded customer trust and pushed the bank to the precipice.

Let’s delve into the key events leading up to this momentous banking union, offering a glimpse into the path that unraveled before us.

In February, Swiss regulators reprimanded Credit Suisse for grave deficiencies in its management of a multi-billion business involving the now-defunct Greensill. This public censure marked the third such incident in two years.

March witnessed further tribulations. Credit Suisse postponed its annual report due to last-minute concerns raised by U.S. regulators about its financial statements. Subsequently, the banking sector as a whole experienced a sell-off following the collapse of Silicon Valley Bank, causing Credit Suisse shares to plummet to an all-time low.

Publishing its belated 2022 annual report on March 14, Credit Suisse acknowledged significant weaknesses in its internal controls over financial reporting. Furthermore, the bank had yet to stem the tide of customer outflows.

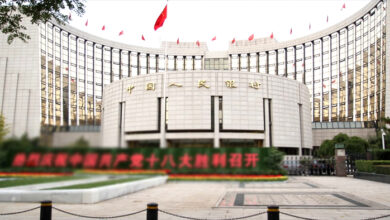

The Swiss National Bank responded by pledging to provide Credit Suisse with liquidity if necessary, a remarkable intervention since the global financial crisis. However, this assurance failed to quell market unease, as the bank’s largest shareholder, Saudi National Bank, declared its intent not to increase its stake. Consequently, Credit Suisse shares plummeted by a fifth.

In a bid to secure its position, Credit Suisse announced on March 16 its intention to borrow up to 50 billion Swiss francs ($55.40 billion) from the central bank.

The emergency rescue plan for Credit Suisse was unveiled on March 19, brokered by the Swiss government, central bank, and financial regulator. Under this agreement, UBS committed to acquiring Credit Suisse for a substantially reduced price of 3 billion Swiss francs in stock, along with assuming potential losses of up to 5 billion francs. UBS later disclosed in a regulatory filing that it had been compelled into a deal it had no desire for.

The rescue triggered a political backlash, with parties from across the political spectrum cautioning against the immense risks and the sheer scale of the resulting entity.

In response, Swiss authorities imposed restrictions on bonus payments for Credit Suisse employees on March 21. Meanwhile, Switzerland’s financial market regulator, FINMA, defended its decision to impose substantial losses on Credit Suisse bondholders, asserting the legality of its actions.

On April 3, Switzerland’s federal prosecutor launched an investigation into the merger. Simultaneously, some holders of Credit Suisse AT1 bonds, who had suffered losses due to the merger, engaged legal representation to explore potential litigation for recovery.

During the bank’s final shareholder meeting on April 4, Credit Suisse Chairman Axel Lehmann apologized to investors for bringing the bank perilously close to bankruptcy.

In a parallel development, the Swiss government mandated Credit Suisse to cancel or reduce all outstanding bonus payments for senior management. UBS, on the other hand, reassured its shareholders that despite the Herculean task ahead, the takeover would ultimately succeed.

As concerns mounted, the Swiss Bank Employees Association demanded a moratorium on job cuts at both banks until the end of 2023. Swiss media had previously speculated that up to 11,000 jobs could be lost within Switzerland.

In a largely symbolic vote on April 12, Switzerland’s parliament rejected the government’s aid for the merger.

The acquisition received approval from the Federal Reserve for UBS’s acquisition of Credit Suisse’s U.S. subsidiaries on April 15.

Credit Suisse reported a substantial outflow of 61 billion Swiss francs in assets in the first quarter on April 24, concurrently presenting what would likely be its final quarterly results.

Switzerland’s Federal Administrative Court disclosed on April 26 that it had received several hundred claims against the country’s financial regulator following the write-off of Credit Suisse’s AT1 bonds.

A regulatory filing from UBS in April indicated that it had considered the consequences of a Credit Suisse takeover in December but had ultimately deemed such a move undesirable.

On May 9, UBS CEO Sergio Ermotti introduced his new leadership team, predominantly comprising seasoned UBS executives, with Credit Suisse CEO Ulrich Koerner being the sole inclusion from the beleaguered bank.

Ermotti declared on May 12 that the situation at Credit Suisse had stabilized.

UBS disclosed potential costs, and benefits, amounting to tens of billions of dollars in a regulatory filing on May 16, underscoring the high stakes entailed in the takeover.

In a decision made on May 17, the office of the upper house of the Swiss parliament designated a special commission to investigate the rescue of Credit Suisse.

The Swiss finance ministry issued an order on May 23 to cancel or reduce outstanding bonuses for Credit Suisse managers, a measure that had been announced in April.

On May 30, Switzerland’s Social Democratic Party revealed a proposal aimed at downsizing UBS assets following the completion of the merger. Their rationale stemmed from concerns that the enlarged bank posed significant risks to the country, given its size and implicit state guarantee.

UBS CEO Sergio Ermotti cautioned on June 2 that difficult decisions regarding job cuts were on the horizon after the Credit Suisse takeover. However, he dismissed concerns that the resultant bank would be excessively large for Switzerland.

Switzerland’s parliament formally sanctioned a special commission to investigate the collapse and rescue of Credit Suisse on June 8.

Finally, on June 9, UBS and the Swiss government reached an agreement on the terms of a 9 billion Swiss franc guarantee to cover potential losses stemming from the sale of certain Credit Suisse assets. This marked the final hurdle preceding the closure of the deal.

($1 = 0.8889 Swiss francs)

($1 = 0.9025 Swiss francs)