IMRAN KHAN RECCOMMENDS FORTY RULES OF LOVE

Try not to go over a great deal of companions ready to share their adoration for TV shows and books? Try not to stress, the Prime Minister has you secured!

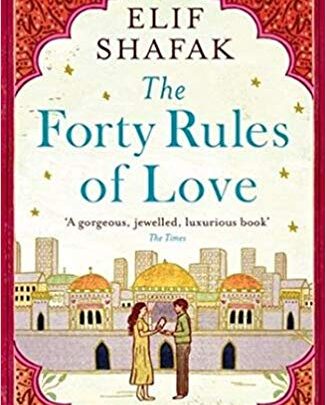

Subsequent to prescribing the young in Pakistan to watch Ertugrul, and we as a whole ability that is turned out, Imran Khan currently needs you to peruse The Forty Rules of Love – a novel that portrays the stories of Maulana Jalal-Ud-Din (Rumi) and his buddy Shams Tabrizi.

Try not to go over a ton of companions ready to share their adoration for TV shows and books? Try not to stress, the Prime Minister has you secured!

Subsequent to prescribing the adolescent in Pakistan to watch Ertugrul, and we as a whole ability that is turned out, Imran Khan presently needs you to peruse The Forty Rules of Love – a novel that portrays the stories of Maulana Jalal-Ud-Din (Rumi) and his partner Shams Tabrizi.

Taking to Instagram, the PTI director imparted his proposal to youthful perusers in the country:

“This October, I propose our childhood to peruse The Forty Rules of Love by Elif Shafak. A motivational book about celestial love, Sufism, Rumi and his Murshid Shams Tabriz. I read it a couple of years back and was profoundly enlivened,” Khan recommended the crowds.

Composed by the Turkish creator in 2009, the novel is set in the thirteenth century and rotates around the life of Ella, who before long starts to scrutinize the numerous ways she has made due with an ordinary life without enthusiasm and genuine love.

Enlivened by the spinning dervish, Shams of Tabriz, a spiritualist provocateur who challenges standard way of thinking and social and strict bias any place he experiences it, Ella’s excursion is both, rousing and supernatural – and the Prime Minister trusts the adolescent removes something positive from it as well.