Toyota is likely to make less money in Q1 because of problems with production.

Tokyo (Reuters) – This week, Toyota Motor Corp. (NYSE: TM) is expected to report that its first-quarter profit fell by more than 10%. This is because a chip shortage and problems with the supply chain forced the world’s largest automaker by sales to cut its production goals more than once.

Due to a lack of semiconductors and the effect of COVID-19 lockdowns in China, the Japanese car company had to cut its monthly production goals three times during the first quarter, from April to June. As a result, it fell 10% short of its original targets.

Toyota is dealing with higher costs and worries that global inflation could slow down consumer demand, just like other companies. Its production problems stand out because they are different from how it dealt with supply problems at the beginning of the pandemic.

Last year, Japan’s biggest automaker made a lot of money in the first quarter because the worst of the pandemic was over. This year, however, the weaker yen is likely to be the only good thing in the first quarter, said Koji Endo, an analyst at SBI Securities.

“The first quarter of last year was all about cutting costs,” Endo said. “Compared to that, profits this time around are likely to have dropped sharply.”

The average prediction from a poll of 10 analysts by Refinitiv is that Toyota’s operating profit for the April-June quarter will drop by 15%, to 845.8 billion yen ($6.47 billion). This will be announced on Thursday. Still, the drop in profit is the smallest the automaker has seen in three quarters.

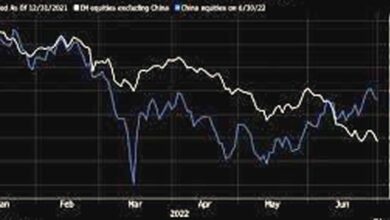

Graphic: Shares of a Japanese automaker – https://fingfx.thomsonreuters.com/gfx/mkt/jnvwengnmvw/image-1659499279920.png

During the April-June quarter, the yen lost about 10% of its value. At one point, it was worth almost 137 yen to the dollar, while Toyota’s prediction for the year was 115 yen.

Most of the time, a weak yen is good for companies that export because it makes them more money when they bring their earnings home. In recent years, though, Japanese companies have been making more things outside of Japan. This means that when the yen gets weaker, their overseas costs also go up.

CHALLENGES

Toyota’s main Japanese competitors, Nissan (OTC:NSANY) Motor and Honda Motor, are also working on long-term problems, such as making cars run on electricity and automating them.

And consumer trust problems are common in Japan. On Tuesday, Hino Motors, a major Toyota affiliate, admitted that it lied about emissions data for longer than was previously known.

Analysts and investors are very interested in whether Toyota can meet its goal of making 9.7 million cars around the world in the current financial year, which ends in March.

Endo of SBI Securities said that meeting that goal would likely depend on the outlook for the chip shortage and supply chains, as well as the outlook for the economy.

But even if the economy slows down, Toyota has a huge backlog of orders, and if the demand for consumer electronics goes down, chips could be moved from making electronics to making cars, he said.

He said that if Toyota doesn’t change its production goal for the whole year in the second quarter, that means it is very sure it can meet the goal with production in the second half of the year.

($1 = 130.6300 yen)