The most recent rise in U.S. stocks raises doubts that the rally will last.

New York (Reuters) – Investors are looking at the recent rise in the U.S. stock market. Similar rallies failed in 2022, which is on track to be the worst first-half drop in the S&P 500 in more than 50 years.

Even though the S&P 500 rose by 6.4% last week, it’s hard to blame investors for being sceptical. This year, the benchmark index has already seen three other gains of at least 6%, only to fall below its previous low point.

Already, the rally is losing steam. Weak data on consumer confidence led to a 2% drop in the S&P 500 on Tuesday. The index closed down more than 20% from its record high in January, which is how most people define a bear market, and it is still down about that much for the year.

Willie Delwiche, an investment strategist at market research firm All Star Charts, said, “It’s up to the bulls to show that it’s not just a bear market bounce.” He pointed out that even during last week’s index rise, more stocks on the New York Stock Exchange and Nasdaq made 52-week lows than highs.

After the big drops this year, many people think stocks are ready for a comeback, even if it won’t last long.

Michael Wilson, a strategist at Morgan Stanley (NYSE: MS), said earlier this week that the rally could go up another 7% from where it is now, but that any short-term gains are “nothing more than a bear market bounce.”

He thinks that the S&P 500, which closed on Tuesday at $3,821.55, is worth between $3,400 and $3,500, while a recession would bring “tactical price lows” to around $3,000.

“The bear market is probably not over, even though it may feel like it over the next few weeks,” Wilson wrote in a note. “The lower rates are seen by the markets as a sign that the Fed can set up a soft landing and keep earnings forecasts from changing a lot.”

In a similar way, Jonathan Krinsky, chief market technician at BTIG, said he expects the S&P 500’s “countertrend rally” to rise to the 4,000–4,100 level by the end of the quarter, “before resuming lower in the third quarter and eventually breaking below 3,500.”

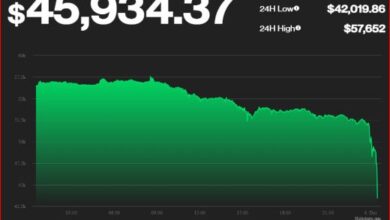

In 2022, the S&P 500 (https://fingfx.thomsonreuters.com/gfx/mkt/dwpkrmydmvm/Pasted%20image%201656446868127.png)

Some investors are feeling better about buying stocks.

The head of investments at Harbor Advisory Corp. in Portsmouth, New Hampshire, Jack DeGan, said that he has been giving his clients more exposure to stocks.

DeGan doesn’t think the economy will go into a recession in the next 18 to 24 months. He also thinks inflation will slow down by the fall, citing the recent drop in the prices of copper and lumber as one reason.

“If what I know about how the economy is going is even close to right, I think we’ve seen the bottom,” “DeGan said. “I’m investing money, so I guess that shows I’m pretty sure of myself.”

As the start of the second quarter earnings season gets closer, the past suggests that the next couple of weeks could be good for stocks.

Bespoke Investment Group says that the S&P 500 has made a median return of 2.15 percent in the two weeks after June 29 over the past 20 years. That’s the best two-week return for any time of year in that time period.

“Investors don’t have much to get excited about in the stock market right now,” Bespoke said in a note this week. “However, the calendar is one trend that is starting to work in the market’s favour.”