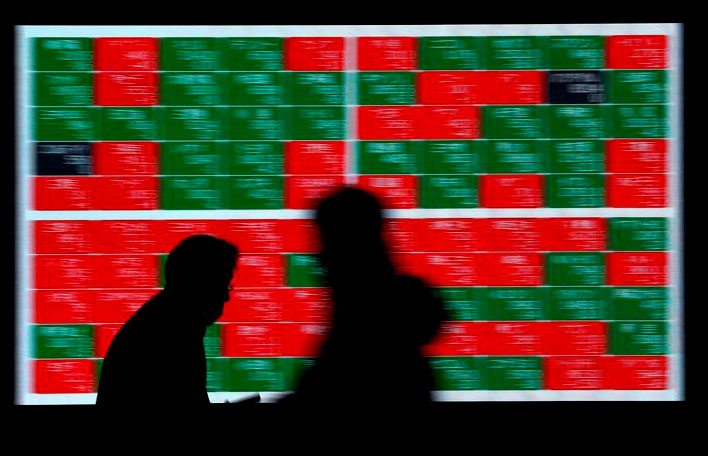

The global stock market declines after Fed officials downplay optimism.

Reuters reports from London.Tuesday saw a decline in global equities as investors cashed in on the gains of the previous two weeks and two Federal Reserve officials injected a note of caution over the future for U.S. interest rates, weighing on equities, commodities, and other risk assets.

The MSCI All-World index declined 0.1%, but remained within striking distance of Monday’s three-week high, while the dollar, a measure of investor risk appetite, remained unchanged versus a basket of other currencies.

China has demolished its zero-COVID policy during the past six weeks, despite a nationwide increase in cases. This has caused choppy markets as investors assess the economic benefits of reopening against the impact of the infection wave.

A lot of people also think that inflation has reached its peak, especially in the United States. This means that the Federal Reserve will not have to raise interest rates as much as many people thought they would have to.

Still, even though consumer price pressures are still well above the central bank’s 2% goal, two Fed members made it clear on Monday that interest rates will keep going up, no matter what investors think.

“The market is attempting to get ahead of the Fed, but it is not listening to what the Fed is saying. “And the Fed’s message is very clear: interest rates will rise and remain elevated for a longer period of time,” “CityIndex analyst Fiona Cincotta remarked.

“If we examine inflation expectations later this week, the primary emphasis – core inflation is projected to remain elevated. It does not matter how you perceive it. The inflation rate is still above the Fed’s objective “She stated,

Inflation is estimated to have slowed to 6.5% in December, down from 7.1% in November, according to consumer pricing statistics scheduled on Thursday.

The statistics could be significant in establishing expectations for the Fed’s upcoming policy meeting and beyond.

Mary Daly, president of the Federal Reserve Bank of San Francisco, told the Wall Street Journal that she would closely monitor Thursday’s statistics and that rate hikes of either 25 or 50 basis points were possible. President of the Atlanta Fed Raphael Bostic stated that in his “base scenario,” there would be no rate reduction this year or next.

“Overnight, caution dominated the equities market as stocks erased gains following hawkish remarks from two Fed members. Raphael Bostic and Mary Daly predicted that the Federal Reserve would likely raise (interest) rates to above 5% and maintain that level for some time “In a note, Commerzbank (ETR:CBKG) stated.

Later on Tuesday, Fed Chair Jerome Powell will speak at a symposium on central bank independence, and markets will likely scrutinise his words for monetary policy clues.

FAILING CHINA

In Europe, stocks opened in the red, with the STOXX 600, which reached its highest level in eight months on Monday, falling 0.7%. The FTSE 100 in London sank 0.3%, while the DAX in Frankfurt fell 0.5%.

Futures for U.S. stock indexes went down by 0.1%, which suggests that Wall Street may open a little lower.

The dollar carved out gains against the Australian dollar, which is particularly vulnerable to the Chinese economy and has gained 3.5% in the last three weeks due to reopening optimism.

The Australian dollar was recently trading 0.2% lower at $0.6903, while the offshore yuan was 0.1% lower against the dollar at 6.7906. The prior day marked its highest level since mid-August.

The dollar index fell 0.21 percent. The euro increased by 0.1%, while the pound decreased by 0.1%. The yen climbed 0.1% against the dollar to 132.04 as statistics revealed a faster increase in Tokyo inflation, which could encourage the Bank of Japan to tighten monetary policy more swiftly.

On Tuesday, strategists at BlackRock (NYSE:BLK), the world’s largest asset management company, projected that the Chinese economy will expand by 6% this year, which should cushion the global downturn as developed-market countries enter recession. But any improvement may be temporary.

“Even after domestic activity has resumed, we do not anticipate China’s economic activity to return to its pre-COVID trend. “We anticipate a reversal of growth once the restart has run its course,” “BlackRock Investment Institute’s global head investment strategist, Wei Li, in a letter.

Copper fell from its highest point in six months as fears of a global economic slowdown cancelled out the good news that China was leaving COVID-19.

Copper futures on the London Metal Exchange declined 0.9% to $8,785 a tonne, after reaching their highest level in over six months on Monday, while aluminium and zinc slid between 1% and 1.4%.

Oil was under pressure because it was possible that China’s return to more regular activity would not lead to a surge in demand.

“The social vitality of China’s big cities is swiftly rebounding, and the resumption of Chinese demand is cause for optimism. However, because the consumption recovery is still in its early stages, the oil price will likely remain low and range-bound, according to analysts from Haitong Futures.

Last time we checked, Brent crude futures were trading at $79.16 a barrel, down 0.6%. The oil price is around 2.3% lower than it was a year ago and 45.5% lower than its all-time high of $139 in February 2014, when Russia invaded Ukraine.