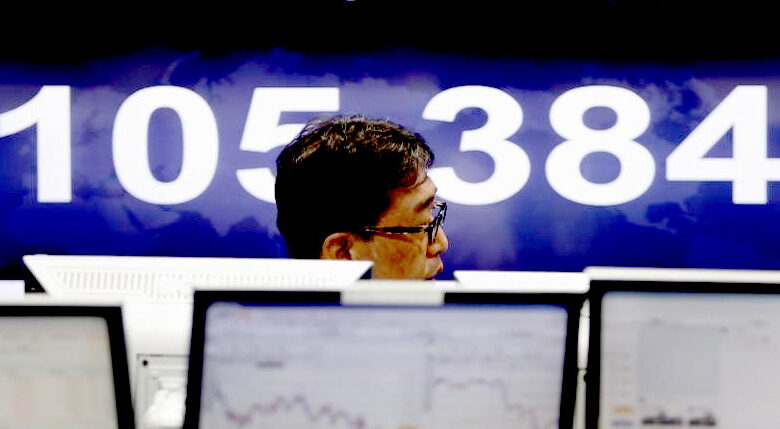

Japan’s stock market is up at the end of the day; the Nikkei 225 is up 0.64%.

After Tuesday’s trading day ended, shares in Japan went up because the mining, power, and shipbuilding sectors all did well.

At the end of the day in Tokyo, the Nikkei 225 went up by 0.64%.

Citizen Holdings Co., Ltd. (TYO: 7762), which rose 16.18% or 100 points to trade at 718.00 at the end of the day, did the best on the Nikkei 225. Kajima Corp. (TYO: 1812) gained 5.41% or 82.00 points to end at 1,598.00, and Tokai Carbon Co., Ltd. (TYO: 5301) went up 4.98% or 59.00 points to 1,244.00 in late trading.

The worst performer during the session was Recruit Holdings Co Ltd (TYO:6098), which fell 5.02% or 220 points to close at 4,159.00.Japan Steel Works Ltd. (TYO:5631) fell 3.62%, or 97.00 points, to end at 2,585.00, and Rakuten Inc. (TYO:4755) fell 1.49%, or 10.00 points, to $662.00.

On the Tokyo Stock Exchange, there were 2,503 stocks that went up, 1,099 that went down, and 225 that stayed the same.

Citizen Holdings Co., Ltd. (TYO: 7762) shares hit their highest point in three years, going up 16.18%, or 100.00, to $718.00. Kajima Corp. (TYO: 1812) shares went up by 5.41%, or 82.00 yen, to a 52-week high of 1,598.00 yen. Shares of Tokai Carbon Co., Ltd. (TYO:5301) reached their highest point in the past 52 weeks, going up by 4.98%, or $59.00, to $1,244.00.

The Nikkei Volatility Index, which measures the implied volatility of Nikkei 225 options, went up by 1.79% to 16.51.

The price of a barrel of crude oil for delivery in March went down 0.80%, or $0.64, to $79.50. In other commodity trading, Brent oil for April delivery dropped 0.42%, or $0.36, to $86.25 per barrel, while the April gold futures contract went up 0.35%, or $6.55, to $1,870.05 per troy ounce.

The USD/JPY fell by 0.34 percent to 131.96, and the EUR/JPY fell by 0.18 percent to 141.69.

At 103.03, the US Dollar Index Futures were down 0.21%.