News

PM,S 2 DAYS VISIT TO SRILANKA

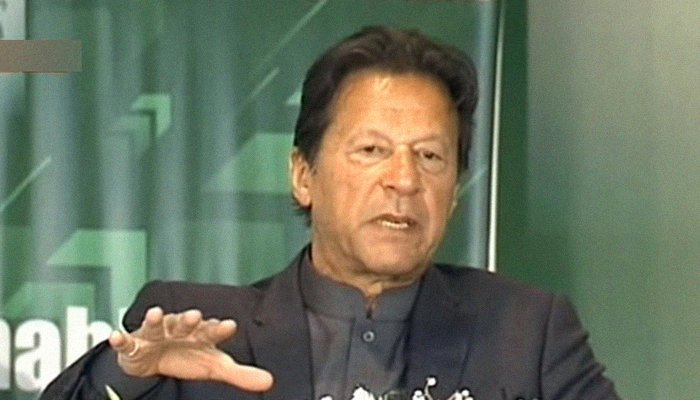

PM Imran Khan on Tuesday showed up in Sri Lanka on a two-day visit to the country on the greeting of the nation’s leader, Mahinda Rajapaksa.

This is his first visit to Sri Lanka in the wake of accepting the workplace of executive.

On appearance in Colombo, the head administrator was gotten by his Sri Lankan partner and introduced a watchman of honor. He was subsequently acquainted with individuals from the Sri Lankan bureau.