T-bill yields can increase by up to 70 basis points.

KARACHI: In the new government’s first auction of treasury notes, cut-off yields increased by 70 basis points, implying that the returns are substantially higher than the interest rate and inflation.

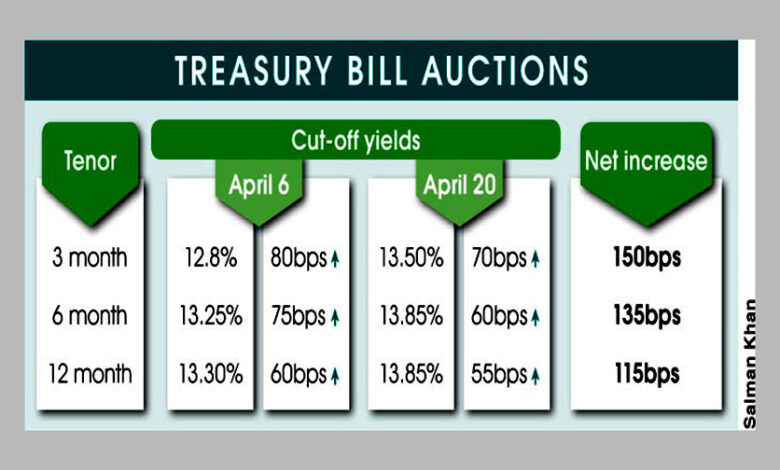

Cut-off yields increased by up to 80 basis points at the previous auction on April 6, creating a significant spread between the policy interest rate and the returns on treasury notes. The next day, Pakistan’s State Bank increased interest rates by 250 basis points, to 12.25 percent.

On Wednesday, the cut-off yield on six-month benchmark treasury notes increased by 60 basis points to 1.6 percentage points above the policy rate or 13.85 percent vs. 12.25 percent.

Despite the 250 basis point increase, the interest rate remains below headline inflation. The Consumer Price Index (CPI) was down 1.7% in March.

While larger yields on treasury notes are appealing, analysts note that the margins are much higher than the interest rate. Treasury bill returns are often 40 to 60 basis points higher than the interest rate.

“There is a likelihood of more interest rate increases after discussions with the IMF (International Monetary Fund), and there may be a need to contain the 12.7 percent inflation,” said S.S. Iqbal, an interbank money dealer.

The three-month treasury notes’ cut-off rate increased 70 basis points to 13.50 percent, raising Rs291bn.

On a Rs 166.3 billion raised, the yield on the benchmark six-month note increased by 60 basis points to 13.85 percent.

Similarly, the 12-month cut-off rate increased 55 basis points to 13.85 percent, and the government raised Rs111 billion.

The government got offers totaling Rs 914 billion, compared to the aim of Rs 600 billion. However, it cost Rs. 613.7 billion in total, including Rs. 45.5 billion in non-competitive bids.

The trajectory was similar to that of the previous government, with the overall accepted sum remaining close to the auction aim.

The past two auctions, on April 6 and April 20, combined increased the cut-off rates on benchmark six-month treasury notes by 135 basis points. On three- and twelve-month notes, total returns rose by 150 and 115 points, respectively.

According to researchers and observers, import-related inflation has a destructive effect on the economy. They said that an increase in imports has a dual negative effect: it depletes the country’s foreign currency reserves on the one hand and fuels inflation on the other.