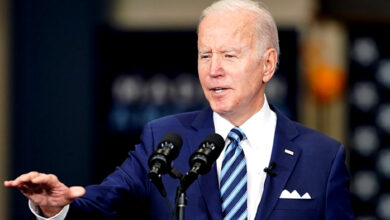

Shares rally as Samsung reduces chip output to weather market downturn

Samsung Electronics Co Ltd, the world’s largest memory chipmaker, has announced a “meaningful” cut to chip production due to a sharp global downturn in semiconductor demand that has caused prices to plummet. This follows similar moves by smaller rivals, with Samsung flagging a worse-than-expected 96% plunge in first-quarter profit.

Despite the profit miss, investors have rallied behind the company, betting that this move will support chip prices that have fallen by around 70% over the last nine months. Samsung’s shares jumped 4.5% in early trading, its biggest one-day rise since September.

The company said memory demand had dropped significantly due to a weak global economy and customers slowing purchases as they focused on using up their stocks. Although cutting short-term production, Samsung is still making long-term investments in infrastructure and research to secure needed clean rooms for chip production and expand its technological lead. However, it did not disclose the size of the planned production cut. Samsung’s chip division is likely to report a record loss of 2.1 trillion won ($1.6 billion), according to an average of analyst forecasts.