News

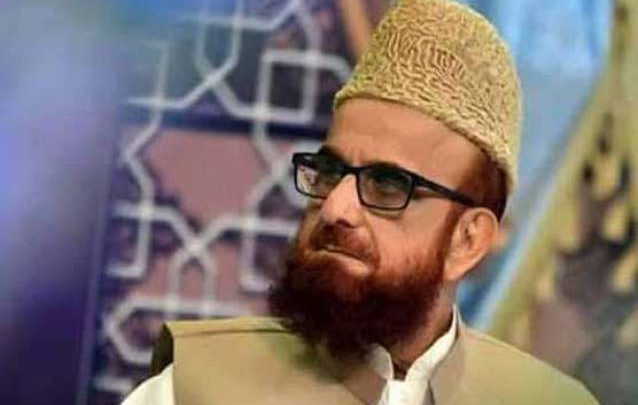

MUFTI MUNEEB SAYS THAT CHARITY NO SUBSTITUTE FOR SACRIFICE

KARACHI: The penance of creatures is a fundamental of Islam officeholder upon every one of

He said that those creation the current conditions (coronavirus episode) a reason for giving out contributions rather were opposing Islamic lessons.

Mufti Muneeb, discussing steers markets in the territory, said that they will be set up a long way from neighborhoods.

“Dairy cattle markets will be set up inside walled-off solid structures instead of open markets as has been the convention,” he stated, including: “Aggregate penance ought to be given need.”

Mufti Muneeb said the purchasers of creature stows away should move the skins to safeguarding focuses not long after getting them.