News

CPEC INTERNSHIP PROGRAMME

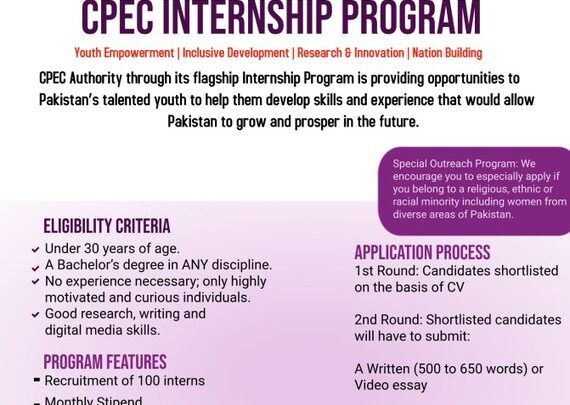

The CPEC Authority will choose 100 individuals with greatest age of 30 years in first temporary job program that will begin in October 2020.

ISLAMABAD: The CPEC Authority has propelled a temporary position program to create youthful pioneers with greatest efficiency.

“It is a comprehensive and national undertaking that will demonstrate as a motor of development for the nation,” Chairman CPEC Authority Lt Gen (retd) Asim Saleem Bajwa said in his tweet on Saturday.