Drifting Stocks: Investors Juggle Rate Hopes and Surging Oil Prices

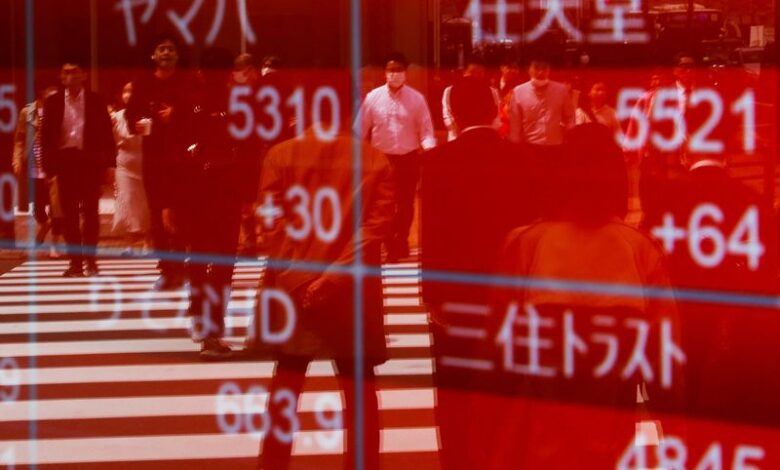

Rollercoaster ride, folks! Global stocks played it cool on Tuesday, riding the waves of inflation from surging oil prices while hoping the big banks wouldn’t tighten their belts too much, fearing it might bring on a dreaded recession.

Picture this: MSCI’s world stocks index, the one that shot up nearly 6% last month when the U.S. Federal Reserve decided to ease off the aggressive rate hikes, stayed steady, barely moving an inch, with Wall Street on vacation for the July 4 shindig.

Over in Europe, the Stoxx 600 share index seemed to have its feet glued in the early deals, not budging an inch either.

Now, Australia’s central bank had a little chat and decided to keep interest rates still at 4.1%, giving the economy a breather to see how their past rate hikes impacted things.

But hold on tight, because things are getting tricky. Oil prices decided to take a hike of their own, climbing up the ladder on Tuesday, as the markets weighed in on supply cuts for August, thanks to Saudi Arabia and Russia tightening their belts.

Brent crude futures climbed 0.6% to a whopping $75.09 a barrel, while West Texas Intermediate crude followed suit, adding the same amount to reach $70.23.

Uh-oh! Brace yourselves for some rough news. Data from the Institute of Supply Management revealed that U.S. manufacturing activity took a nosedive in June, reaching levels last seen during the initial wave of the COVID-19 pandemic back in May 2020. The euro zone was not spared either, with their purchasing managers surveys pointing to a similar factory downturn.

Looks like there’s a silver lining, though. Capital Economics global economist, Ariane Curtis, piped up, saying that at least the supply-demand balance seemed to be helping with price pressures. But she sounded the alarm too, warning that even with goods inflation cooling down, central bankers might keep their guard up to tackle sticky service-sector inflation.

Hold your breath, folks! Investors are on the lookout for an unpredictable mix of economic data before the second-quarter earnings take the stage. The big question mark still hangs over the Fed’s monetary policy, keeping everyone on their toes. Manishi Raychaudhuri, the head of Asia Pacific equity research at BNP Paribas, knows this dance well. He says the minutes from the central bank’s latest meeting, expected later this week, could send some shockwaves through the markets.

And if the Fed goes all out and does more rate hikes than expected, buckle up for a bumpy ride! A deeper recession might be on the horizon, which is not a great sight to see.

Hold tight, there’s more drama! Geopolitical tensions are like unwanted guests at the party. China’s export controls on minerals are throwing more uncertainty into the mix of global trade relations.

In the currency arena, the dollar index decided to play it cool, not showing any major moves against its major peers. But the euro couldn’t resist the temptation to dip 0.3% lower against the dollar, hitting $1.09115.

Euro zone government debt, like a calm lake, remained steady. Germany’s two-year Schatz yield, which tracks interest rate expectations, did its thing around 3.32%, lingering close to its highest level since early March. Remember that regional banking crisis in the U.S.? It caused a frenzy, driving everyone into safe havens.