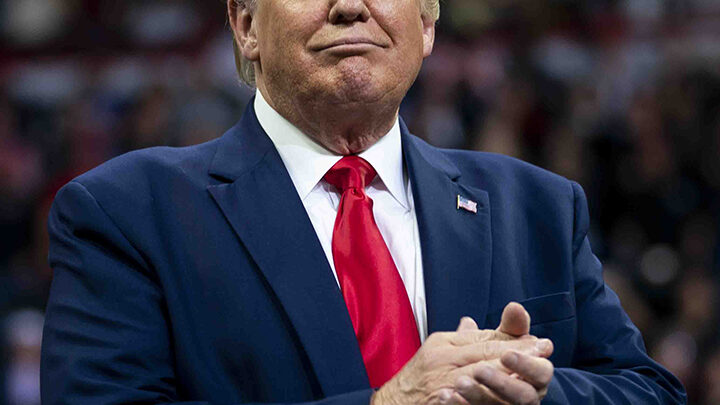

TRUMP RAISES POSSIBILITY OF DELAYING ELECTIONS

US President Donald Trump on Thursday raised the chance of postponing the country’s November presidential political race in spite of its date being revered in the nation’s constitution, drawing quick protests from Democrats.

It was not satisfactory if Trump was not kidding and any such move would require activity by the US Congress, which holds the ability to set the planning of decisions.

Trump, without proof, rehashed his cases of mail-in voter misrepresentation and brought up the issue of a deferral, stating: “postpone the political race until individuals can appropriately, safely and securely vote???”

Agents for the White House didn’t quickly react to a solicitation for input.

Trump has provided reason to feel ambiguous about the authenticity of mail-in polling forms, which have been utilized in far more noteworthy numbers in essential races in the midst of the coronavirus pandemic. He has additionally made unverified charges that casting a ballot will be fixed and has wouldn’t state he would acknowledge official