current account deficit more than doubled to $1 billion.

In March, the current account deficit doubled to $1 billion, which is more than twice as much as it was in February.

KARACHI: There was an almost two-fold increase in the country’s current account deficit last month, from $800 million to $1 billion. This means that in March alone, there was a deficit of more than $13 billion for this fiscal year’s first nine months (July-March).

The State Bank of Pakistan (SBP) released new data on Saturday that could be very bad news for the new government, which is trying to get $1 billion from the IMF.

In March, the current account deficit doubled to $1 billion, which is more than twice as much as it was in February.

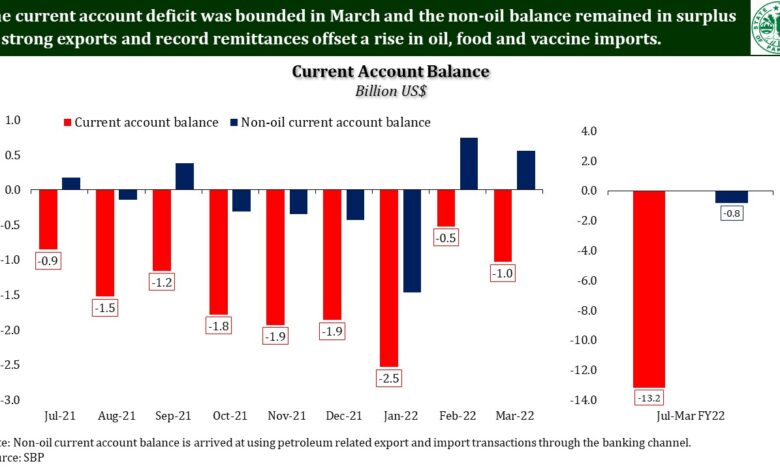

Despite high global commodity prices, the turnaround in the current account continues, with a deficit of $1bn in Mar, $500mn lower than the average during FY22. Moreover, the non-oil balance remained in surplus for the 2nd consecutive month. https://t.co/Od8ikVvpBF pic.twitter.com/bQCNHQjOSz

— SBP (@StateBank_Pak) April 23, 2022

KARACHI: There was an almost two-fold increase in the country’s current account deficit last month, from $800 million to $1 billion. This means that in March alone, there was a deficit of more than $13 billion for this fiscal year’s first nine months (July-March).

The State Bank of Pakistan (SBP) released new data on Saturday that could be very bad news for the new government, which is trying to get $1 billion from the IMF.

Since the start of this fiscal year, the government hasn’t been able to stop the trade deficit from growing, which has led to bigger current account deficits.

It doesn’t matter that global commodity prices are high. The current account turned around in March, with a deficit of $1 billion, $500 million less than the average deficit for FY22. In addition, the non-oil balance was in surplus for the second month in a row, the SBP said in a tweet.

If you look at how much money came in and went out of the country, it was $13.169 billion less than last year.

The State Bank said that in the first nine months of this year, import growth was 41.3 percent, compared to 11.5 percent growth in the same time last year.

People bought goods and services worth $62.137bn in July-March, while they exported goods and services worth $28.855bn. Rising imports are making the trade deficit bigger and destroying the value of the dollar because the demand for dollars was so high this fiscal year.

A look at the data for each quarter shows that the current account deficit was $3.526bn in July-September, $5.565bn in October-December, and $4.078bn in January-March, which works out to about $4.4bn per quarter. There may be a $17.5 billion deficit at year’s end.

The previous government tried to cut down on the import bill by putting more taxes on imported goods, especially luxury goods.

Because of rising oil prices, it didn’t. From July to March, Pakistan spent more than $14 billion on petroleum products from outside the country. That’s almost twice as much as it spent on oil last year.

For the three months from July to March, the State Bank said the balance of goods and services trade was in the red by $33.276 billion, which is more than double what it was last year.

These twin deficits would make the new government nervous, and it needs to take a lot of different steps to fix the problem.

Speculators can destabilize the exchange rate if the SBP-led foreign exchange reserves fall a lot. They can do this because the reserves are now only $10.8 billion.

Interest rates were recently raised by 250 basis points, to 12.25 percent, and there is a chance that it will be raised even more.

Since the start of this fiscal year, the government hasn’t been able to stop the trade deficit from growing, which has led to bigger current account deficits.

It doesn’t matter that global commodity prices are high. The current account turned around in March, with a deficit of $1 billion, $500 million less than the average deficit for FY22. In addition, the non-oil balance was in surplus for the second month in a row, the SBP said in a tweet.

If you look at how much money came in and went out of the country, it was $13.169 billion less than last year.

The State Bank said that in the first nine months of this year, import growth was 41.3 percent, compared to 11.5 percent growth in the same time last year.

People bought goods and services worth $62.137bn in July-March, while they exported goods and services worth $28.855bn. Rising imports are making the trade deficit bigger and destroying the value of the dollar because the demand for dollars was so high this fiscal year.

A look at the data for each quarter shows that the current account deficit was $3.526bn in July-September, $5.565bn in October-December, and $4.078bn in January-March, which works out to about $4.4bn per quarter. There may be a $17.5 billion deficit at year’s end.

The previous government tried to cut down on the import bill by putting more taxes on imported goods, especially luxury goods.

Because of rising oil prices, it didn’t. From July to March, Pakistan spent more than $14 billion on petroleum products from outside the country. That’s almost twice as much as it spent on oil last year.

For the three months from July to March, the State Bank said the balance of goods and services trade was in the red by $33.276 billion, which is more than double what it was last year.

These twin deficits would make the new government nervous, and it needs to take a lot of different steps to fix the problem.

Speculators can destabilize the exchange rate if the SBP-led foreign exchange reserves fall a lot. They can do this because the reserves are now only $10.8 billion.

Interest rates were recently raised by 250 basis points, to 12.25 percent, and there is a chance that it will be raised even more.