Credit Suisse’s delay in annual report leads to European stocks’ decline

European stock markets traded lower due to a combination of weak Chinese inflation data, concerns over Credit Suisse’s health, and comments from Fed Chair Jerome Powell.

The DAX index in Germany traded 0.1% lower, the CAC 40 in France dipped 0.4%, and the FTSE 100 in the U.K. fell 0.6%. The Chinese inflation data released earlier in the session pointed to a sluggish economic recovery in the country, which is a major export market for European companies.

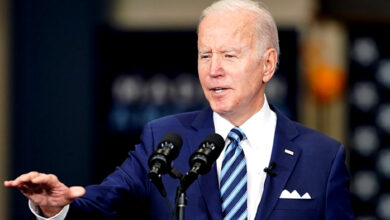

Powell reiterated his message that interest rates would have to go higher to tame inflation, but emphasized that any moves would be data-dependent.

Credit Suisse stock fell 3% after the bank delayed the publication of its 2022 annual report due to regulatory questions. Aviva stock rose 3.7% after announcing a new £300 million share buyback and higher future dividends.

Meanwhile, Deutsche Post stock fell 1% after the company warned of challenges stemming from an uncertain economic environment. Oil prices traded largely unchanged on Thursday, while gold futures rose 0.1% and the EUR/USD traded 0.1% higher.