CoinGecko’s New Addition: A List of Crypto Tokens Possibly Seen as Securities

Imagine this: a whopping $85 billion in crypto assets potentially falling under the “alleged SEC securities” category! It’s the kind of stuff that gets your heart pumping if you’re into the wild world of crypto.

Enter CoinGecko. They’ve taken the bull by the horns and launched an index for all those big hitter crypto tokens that the U.S. Securities and Exchange Commission (SEC) might just give the stink eye to as securities. And boy, are there some familiar faces on that list!

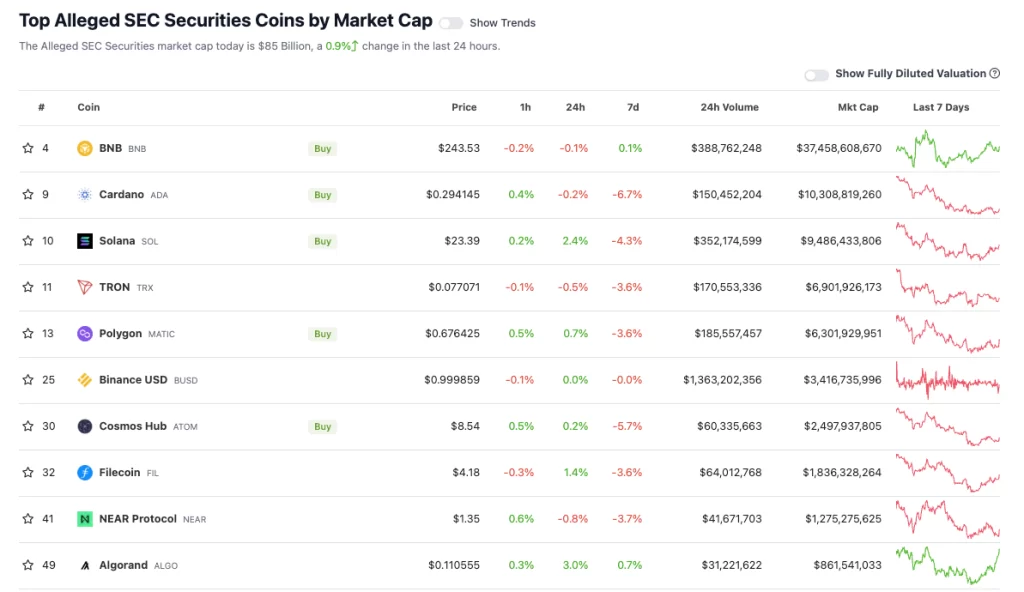

It’s like a who’s who of crypto assets on their “Top Alleged Securities Coins” page. Sorted by market cap, the list is a sight to behold. BNB? Yup, that’s there, sitting pretty with a $242 tag. What about Cardano ADA? Check, listed at a humble $0.292. Don’t forget Solana at $23.05 and TRON rounding things off at $0.0767.

You might wonder, when did all this start? Well, a birdie from CoinGecko, speaking to Cointelegraph, spilled the beans that the index saw the light of day in the first week of August. They put it together by handpicking a bunch of the notorious tokens that had the pleasure of being labeled as securities by the SEC in past lawsuits.

But here’s the kicker. In their latest lawsuits against heavyweights like Coinbase and Binance, the financial watchdog pointed the finger at a total of 68 tokens as securities. In contrast, CoinGecko is playing it safe, only listing 24 of them.

As per CoinGecko’s tally, these hotshot tokens in the SEC’s legal crosshairs represent a cool $84.9 billion of the total market. To give you some perspective, that’s a chunky 7.5% of the mind-boggling $1.21 trillion total crypto market capitalization.

In the meantime, SEC Chair Gary Gensler has been bending over backward to drive home the point that the lion’s share of crypto assets should be deemed securities. He’s even gone so far as to say, “everything other than Bitcoin” is a security. If he’s right, then pretty much every one of the roughly 25,500 cryptocurrencies listed on CoinMarketCap could find themselves under the SEC’s microscope. Talk about a plot twist, huh?