Citi says to buy US and UK stocks, and it thinks that global stocks will go up by 18% by the end of 2023.

Citi strategists have kept their Overweight rating on U.S. stocks because they think that EPS forecasts should be strong. Citi also gave an overweight rating to UK stocks, but it gave a neutral rating to both emerging markets and Europe. On the other hand, Japan and Australia are not a big part of the strategists’ plans.

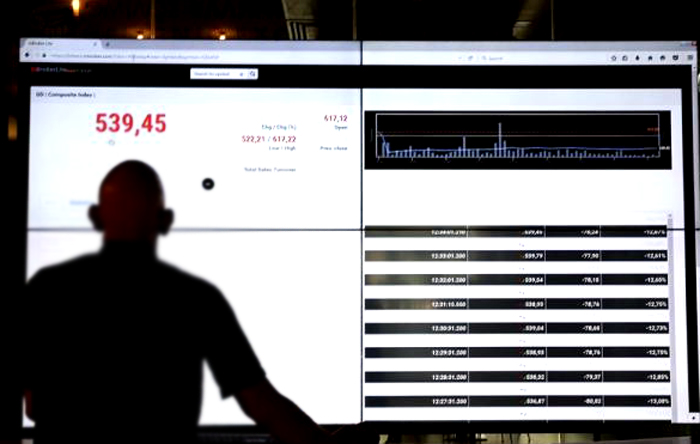

The strategists think that the MSCI AC World, which is often used as a measure of global stocks, will go up by 18% by the end of 2023. However, they also say that global stocks face “considerable” risks. Overall, YTD moves have made stock prices look better, but investors should be more selective.

“Still, the US (16X) seems to be the most expensive. The UK (9x) and EM are the most affordable major markets (11x). Higher yields make fixed income more appealing, but the US is still the only developed country where 10-year bonds yield more than stocks. “Citi’s Levkovich sentiment index (US Panic/Euphoria) is now in the panic zone, which suggests a good short-term entry point,” the strategists wrote in a client note. However, they warned against “chasing the rallies.”

The strategists agree with his colleagues at other major research firms that EPS forecasts are too high. EPS growth for the MSCI AC World is expected to be 10% in 2022 and then 6% in 2023. Citi says that the economy will shrink by 5% in 2023.

Related: Asian stocks go up, and oil keeps going up after the OPEC+ deal.

“We want to remind you that the average drop in earnings per share during the last three big global profit recessions was 31%. Forecasts for Japan and Europe, which have more cyclical economies, look the most at risk, but weak currencies may help limit the damage. There are also risks in cyclical sectors. Traditional defensive sectors should have more stable forecasts, the strategists said.

Citi raised IT to Overweight because prices were getting more attractive, and they are still bullish on Financials.