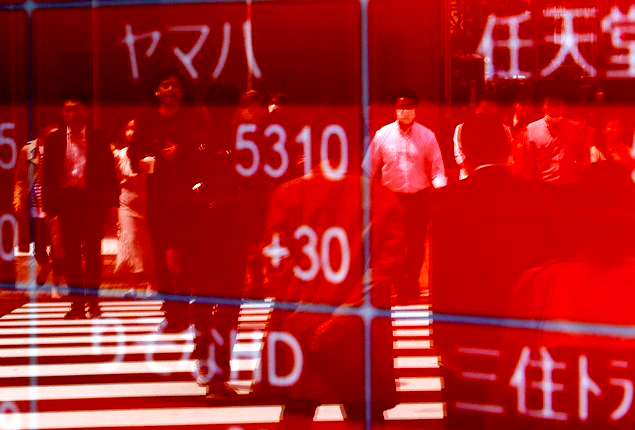

Asian Stocks Plunge to 9-Month Trough Amid China Concerns and U.S. Rate Speculations

SINGAPORE – Market tremors resonated as Asian equities plummeted to their lowest in nine months this Thursday. Simultaneously, the dollar brandished its might, reaching its zenith in two months. The underlying causes? Lingering anxieties about China’s lackluster economic rejuvenation coupled with looming apprehensions that the U.S. Federal Reserve might augment interest rates.

The MSCI’s comprehensive Asia-Pacific share index, excluding Japan, skidded to a modest 495.03, reminiscent of its stature from late November. However, it later recouped some ground, finishing 0.49% lower at 500.43. Alarmingly, this index has declined roughly 8% in August, hinting at its most dismal monthly performance since the previous autumn.

Europe seems poised to mirror this sentiment. Early indicators revealed dips in the Eurostoxx 50, German DAX, and the FTSE futures. Further, the pan-European STOXX 600 recently recorded a one-month nadir, burdened by luxury sectors sensitive to China’s consumer pulse.

Recent weeks have seen Chinese equities languishing. Successive economic reports have painted a somber picture of the nation’s post-COVID resurgence. Investors remain skeptical, voicing their desire for amplified economic stimuli.

Recent figures showcased China’s renowned CSI 300 Index remaining stagnant, whereas Hong Kong’s Hang Seng Index retreated 0.12%, having previously nose-dived to an alarming low this year.

Herald van der Linde, HSBC’s preeminent Asia equity strategist, opined, “Anticipate more strategic moves from decision-makers. But patience is the essence.” He emphasized the current tepidity towards Chinese investments, linking it directly to investor confidence. He added, “A consumer-oriented stimulus might be the antidote.”

The precariousness enveloping China’s economy exacerbates with the intensifying real estate turmoil. Prominent enterprise, Zhongzhi, recently apprised its stakeholders of an imminent liquidity crunch and prospective debt reconfiguration. Alarmingly, this follows missed payment incidents by its major affiliate, Zhongrong International Trust Co.

Interest Rate Jitters

The U.S. financial hub, Wall Street, wrapped up on a diminished note. Minutes from the Federal Reserve’s July rendezvous revealed polarized views on the necessity of further interest rate augmentations. While some underscored the perils of excessive rate escalation, a majority remained laser-focused on curbing inflation. Following a hiatus in June, the central bank raised rates by a quarter percentage in July.

However, market experts from ING predict potential pauses in rate hikes, foreseeing its stabilization in September with potential hikes either in November or December.

Current market dynamics reveal an 86% probability of the Federal Reserve maintaining rates in September, and a 36% likelihood of an increment in November.

In brighter news, U.S. single-home constructions exhibited a surge in July. This bolstering sign, coupled with a resilient economy, has economists re-evaluating their recession predictions.

Uncertainties surrounding rates have benefited Treasury yields, with the 10-year yields touching a high unseen since last October. Meanwhile, the dollar index triumphed, reaching a two-month apex, driving investors towards more stable assets.

The Japanese yen also saw fluctuations, with speculations rife about potential interventions by Japanese policymakers.

On the commodities front, oil prices recorded a decline for the fourth consecutive session, with U.S. crude and Brent both seeing marginal drops. Conversely, surging rates have hampered gold, which recently plummeted to a five-month trough.