As a hawkish Fed weighed in, Asian stocks declined and experienced weekly losses.

Due to hawkish comments from Federal Reserve officials, which made people worry that rising interest rates could cause a recession, most Asian stock markets went down on Friday and were expected to go down for the rest of the week.

The region’s poorest performer this week was Hong Kong’s Hang Seng index, which is on track to post a 2.4% weekly loss. A ban by the United States on semiconductor shipments to China and rising U.S. Treasury yields particularly hurt technology firms in the Hang Seng.

On Friday, the Hang Seng also fell 0.7%.

Chinese stocks were expected to end the week with a small loss, but good news about COVID restrictions and hopes for stimulus measures helped keep losses to a minimum.

Even though the government said it would stick to the strict zero-COVID policy, reports that Beijing will ease some COVID quarantine requirements made people feel better about China.

Along with the government’s assurances of more stimulus spending, the People’s Bank kept interest rates at accommodating levels, which helped boost sentiment. The Shanghai Shenzhen CSI 300 index didn’t change on Friday, and it was expected to go down 0.6% for the week. This would be the third week in a row that the index has gone down.

The Chinese government has put off for an indefinite amount of time the release of the economic growth report for the third quarter. This is now the main focus.

This week, Asian markets fell as a result of hawkish remarks made by Federal Reserve officials. Most recently, Patrick Harker, president of the Philadelphia Fed, said that the central bank is actively trying to slow down the economy to fight inflation. This raised fears of a U.S. recession.

In response to his remarks, U.S. Treasury rates shot up to levels last seen during the 2008 financial crisis as investors began to plan for future Fed interest rate increases.

According to the markets, there is almost a 100% chance that the central bank will raise rates by 75 basis points in November.

Despite encouraging signs from several business profits, Wall Street indexes fell Wednesday night.

After data revealed that CPI inflation reached an eight-year high in September, indicating further pressure on the Japanese economy, the Nikkei 225 index declined 0.5%. Additionally, the yen fell to its lowest point since 1990.

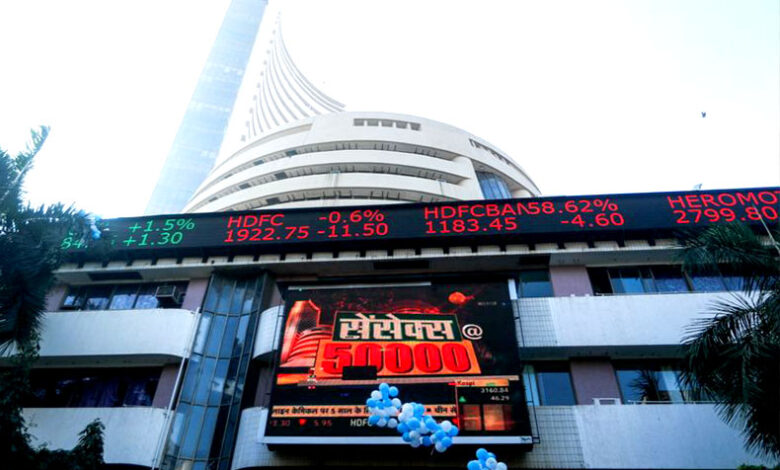

In contrast, the Nifty 50 index for India increased by 0.4%. With a 2.6% increase, the index was again Asia’s strongest performer this week.

Major banks and consumer staples, which stand to gain from rising interest rates and high levels of inflation in the nation, were the main drivers of the Nifty 50’s gains.