World Trade

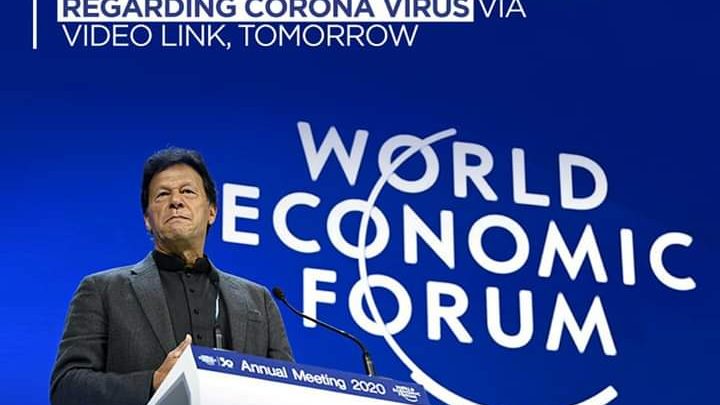

PM Imran Khan will address emergency meeting of World Economic Forum

Prime Minister Imran Khan will address emergency meeting of World Economic Forum (WEF) today via video link. World Economic Forum earlier invited Prime Minister Imran Khan to attend the forum via video link.

The meeting will be attended by leaders from entire world to discuss coronavirus pandemic and its effects on world. PM Imran Khan is expected to apprise the forum about steps taken by Pakistan to curb the spread of novel coronavirus.