A report suggested China may separate bankers and analysts in IPOs.

Shanghai The official Shanghai Securities News on Tuesday said that China’s securities association has made rules to put a wall between investment bankers and analysts in transactions. This is to make sure that the prices of initial public offerings (IPOs) are fair.

Related: The ECC postpones a report of payables to government-owned power plants.

A Chinese publication said that the Securities Association of China forbids bankers involved in an initial public offering (IPO) from sharing profit projections and values with analysts. Instead, analysts must come to their own conclusions.

According to the guidelines, which were sent to brokerages for their input, brokerages are also required to conduct frequent checks on their internal firewall systems.

Such regulations would avoid pricing distortions and safeguard investor interest in a market vital to supporting innovation and growth in the second-largest economy in the world.

China has put in place an IPO method based on registration, like the one used in the U.S., in part of its stock market to make share prices more driven by the market. The country plans to make this change to the whole market in the near future.

Related: Final report: firefighting plane that crashed in Australia and killed 2 likely stalled.

In such an IPO system, the importance of a company’s valuation report is growing, but analysts’ degrees of independence in drafting such assessments are insufficient, and some are horribly wrong, the newspaper reported, citing China’s securities organisation.

The document stated that in order to minimise conflicts of interest, investment bankers would be prohibited from discussing earnings predictions and valuations with analysts during an IPO transaction. But they will be able to talk about the basics of the issuer in front of compliance officials.

The regulations say that issuers, investment bankers, and salespeople can’t put pressure on analysts to change the results of their studies.

Related: By Senad Karaahmetovic According to a Beat-and-Raise Report, Ulta is a “Relative Star of Positivity” in the Retail Sector.

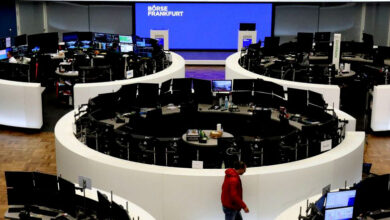

A newspaper said China may erect a wall between bankers and analysts in IPO transactions.