Ex-SBP governor: The private sector gets money from the government.

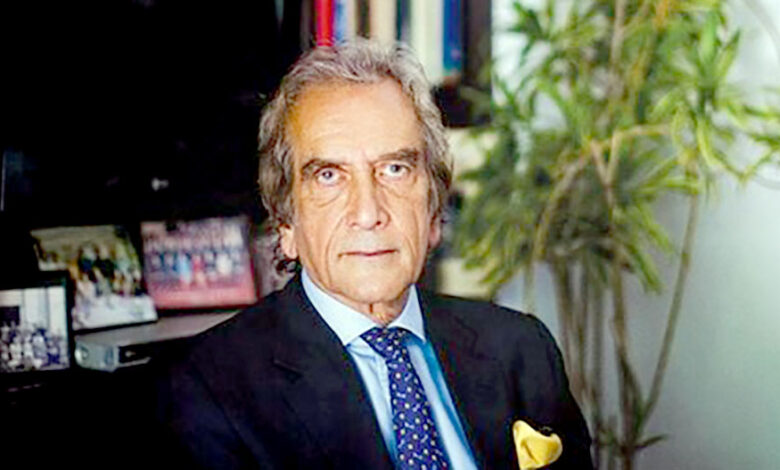

KARACHI: Syed Salim Raza, a former central bank governor, came out with all guns blazing on Monday against the private sector that gets money from the government even though it doesn’t work very well.

The former governor of the State Bank of Pakistan (SBP) spoke at a meeting of the Pakistan Institute of Development Economics. He said that the government hasn’t been planning the economy very well for the last few decades, which has led to an inefficient private sector and “pockets of industrialization with big gaps.”

From 2009 to 2010, Mr. Raza was the head of the SBP, and he said that “all of our private sectors live off of huge subsidies.”

Because it is so well-known, the Temporary Economic Refinancing Facility (TERF) is a long-term subsidy for the import of machinery. He also said that he didn’t like that.

: “It’s going to help you 10%.” Most of the money (Rs 500 billion) has been spent on textile plants. A little less weaving and a lot more spinning, if that makes sense. Back to yarn and cloth: It hasn’t gone into clothes or anything else that can make our textiles better than the rest of the world. Was this helpful? What are we going to do about them when it comes to big businesses?

Speaking at length about the problem of domestic debt, Mr. Raza said that it has become an “absolute choke.” This has made it hard for the government to pay for things like schools, roads, and so on. He said that more debt repayments led to a bigger fiscal deficit and clogged up the balance sheets of commercial banks.

A lot of government money comes from banks, which is a lot higher than in other countries that are just starting out. A lot of places, more than 45%, would be rare.

Almost half of the money banks have available to lend is in government bonds now, he said. It is in addition to the government’s support for about 12–15 percent of bank lending.That leaves roughly 33% for everyone else.

In order to borrow from banks, the government pays a lot of money for it. This is not true. This doesn’t make sense at all. Do the banks bail out the government? He said: “It should be the other way around.”

Mr. Raza thinks that the government should stop borrowing from banks and start borrowing from mutual funds instead. Bank depositors should be able to move from low-paying time deposits to high-paying treasury bills through fund managers. ” They can run the government. He said the National Investment Trust could become one of them. The government should pay attention to the “enormous amounts of money” that it can get out of banks and into its own mutual funds, he said.

Government borrowing rates will go down, and those that banks pay to depositors will go up. When all interest rates are raised, they will be compared to the rate the government charges, he said.

I think this is true all over the world. In money market funds, there is a lot more US government security paper than there is in banks. “Totally different things are going on here,” he said.