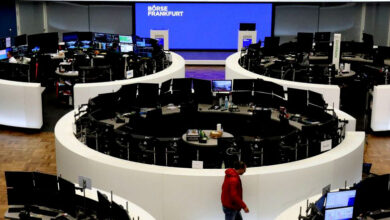

European bank shares lose steam, leading to a drop in European stocks

On Wednesday, European stock markets saw a decline as banks reduced early gains and investors monitored the U.S. financial sector while making predictions about the future of the Federal Reserve’s monetary policy. By 04:40 ET (08:40 GMT), the pan-European Stoxx 600 dropped by 0.55%, the FTSE 100 in the U.K. decreased by 0.54%, France’s CAC 40 fell by 0.71%, and the DAX index in Germany declined by 0.37%.

The Euro Stoxx Banks index, which has been in the spotlight as traders worry about potential worldwide contagion from the collapse of Silicon Valley Bank last week, also decreased after briefly rising during the market open.

U.S. banks led a recovery on Wall Street, partly due to consumer inflation data, which largely met expectations for February. The data, combined with pressure on the banking sector, led to predictions that the Fed would have limited room to raise interest rates.

Traders believe that growing pressure on lenders, as well as indications that overall inflation eased in February, will prompt a less hawkish Fed in the upcoming months. However, traders are still positioning for a 25 basis point hike by the Fed next week, as core inflation remained relatively elevated in the country.

In Asia, the U.S. rally continued, with technology-heavy bourses in Hong Kong and South Korea, in particular, seeing an increase. Broader markets in the region also increased, as fears of a U.S. banking crisis eased after the government intervened in the sector to protect depositors following the collapse of Silicon Valley Bank.

In Europe, attention has turned to a significant meeting of the European Central Bank (ECB) this week. ECB policymakers have previously indicated that they will raise interest rates by another 50 basis points, prompting observers to watch for any indications about future decisions.

In corporate news, despite weaker returns in the final quarter, Zara-owner Inditex (BME:ITX) posted a 29% jump in annual profit, thanks to “historic” growth in sales both in its physical stores and online. The company’s shares fell in early trading. Meanwhile, German automaker Bayerische Motoren Werke AG (ETR:BMWG) saw a slight increase after announcing that it would halt any upcoming price increases for its vehicles in 2023 and that deliveries of cars to customers would increase as supply chain constraints ease.

Furthermore, oil markets saw a rally, with prices for the U.S.-benchmark West Texas Intermediate crude rebounding from its lowest close in three months as traders assessed the outlook for demand and banking sector turmoil. U.S. crude futures traded 1.40% higher at $72.33 a barrel, while the Brent contract moved up by 1.32% to $78.47 per barrel. On the other hand, gold futures fell 0.95% to $1,892.75/oz, while EUR/USD traded broadly near the flatline at 1.0735.