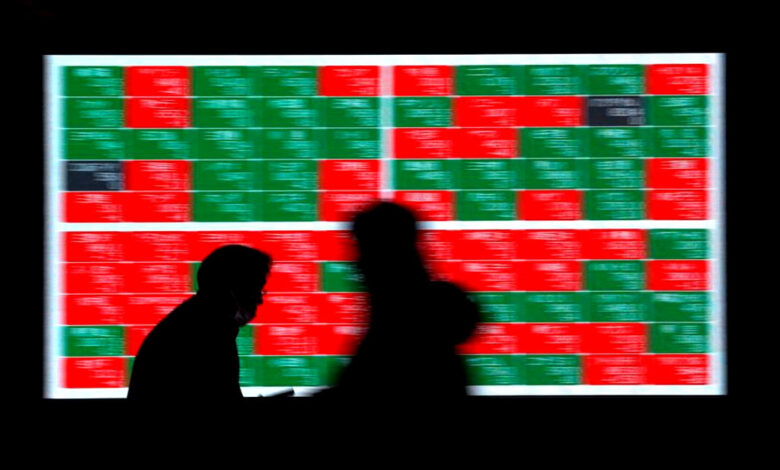

Asia’s markets are expected to fall this week as Fed rate anxiety grows.

On Friday, investors worried about the possibility of additional Federal Reserve tightening and its possible effects on the economy, sending Asia-Pacific equities down once more and heading for their second weekly loss.

After Richmond Fed President Thomas Barkin added to a chorus of hawkish central bank comments in recent days, US short-term Treasury rates remained near a one-month high, helping the dollar edge higher against key peers.

After losing 1.16% the week before, MSCI’s largest index of Asia-Pacific equities fell 0.91% and was headed for a weekly fall of 1.36%.

Blue-chip stocks on the mainland of China fell 0.73%, and the Hang Seng fell 1.76%.

Related: Asia’s markets fall as investors become less risk-averse and yields increase.

China’s January factory gate prices dropped more than economists anticipated, indicating that upstream industries are not yet strong enough to revive the domestic demand that briefly pushed consumer prices when the zero-COVID policy ended.

The benchmark in Australia fell 0.76%, and the Kospi in South Korea fell 0.72%.

The Nikkei in Japan defied the trend and increased by 0.25% thanks to some good earnings reports.

Following the overnight decline of 0.88% in the S&P 500, U.S. equity futures fell 0.12%. German DAX futures predicted a 0.9% drop at the restart, while British FTSE futures predicted a 0.44% drop.

“Has inflation slowed down?” Barkin stated as much in a podcast posted to the Richmond Fed’s website, adding that he believed the downturn had been “distorted” thus far “by a few declining commodity prices.”

Investor attention is currently focused on significant US consumer price data anticipated on Tuesday.

“Where is the pain trade?” “I contend that an upside surprise would surprise the market more than a downside surprise,” Chris Weston, Pepperstone’s head of research, said in a client note about the US inflation figures.

“Those who are not significantly short on risk (are) desperate to see the vision of lower inflation become a reality.”

Investors were pleased at the start of this week when Fed Chair Jerome Powell chose not to adopt a more pessimistic tone in the wake of much stronger than anticipated jobs data at the end of last week.

According to Tony Sycamore, a strategist at IG, “Powell kept a relatively dovish tone, and markets interpreted that as a green light to rally, but pretty much 24 hours later we received a flood of incredibly hawkish Fed rhetoric.”

“Markets are absolutely not priced for that if rates go above that five to five and a quarter percent range that the Fed has previously stated.”

The current rate cycle is expected to peak in July at roughly 5.15%, according to the money markets.

After peaking at 4.514% overnight, the two-year Treasury yield dipped slightly to approximately 4.49% in Tokyo. It had been at that level since January 6. The 10-year yield increased to about 3.96% mid-week, which was also its highest level since January 6, before edging down to about 3.67%.

The U.S. dollar index, which compares the dollar to six other currencies, including the euro and the yen, edged up slightly to 103.27 this week, remaining in the middle of its range. On Tuesday, it reached 103.96 for the first time since January 6.

The market continued to vacillate between worries about an impending recession in the United States and expectations for a robust recovery in China, the world’s top oil importer, leading to a Friday decline in crude oil prices but a weeklong gain nonetheless.

Related: Asia’s markets were shaky because of the possibility of a recession.

While U.S. West Texas Intermediate (WTI) crude futures fell 41 cents, or 0.5%, to $77.65 per barrel, Brent crude futures fell 35 cents, or 0.4%, to $84.15 per barrel.