“Boomerang CEOs” don’t always work out, but Disney hopes that this one will be an exception.

NEW YORK: Can Walt Disney Co. (NYSE: DIS) count on another hit sequel?

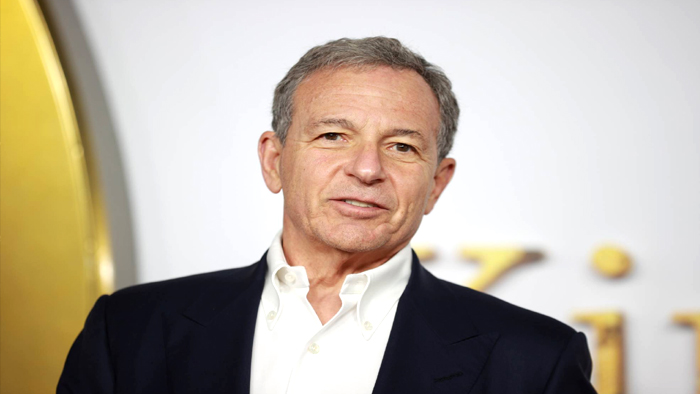

This seems to be what the company was hoping for when it surprised everyone by hiring Bob Iger back as CEO to replace Bob Chapek. Wall Street was mostly happy about the decision. On Monday, Disney’s stock went up more than 6%, which cut its loss for the year so far to 37%.

The change will happen right away.

Related: Bob Iger was reinstated by Disney as CEO in an effort to spur growth.

During his first term, from 2005 to 2020, Disney’s annualized shareholder returns exceeded 14%, far outperforming its competitor Comcast Corp (NASDAQ: CMCSA) and the overall stock market. During that time, the stock rose more than 400%.

Analysts and some investors say that it’s not a given that a returning CEO will do as well as they did before, and that giving them the reins again may be a sign that a company’s culture isn’t doing well.

“From a governance point of view, it’s a big red flag,” said Brian Frank, whose Frank Funds have owned Disney on and off in the past but don’t now because they think the company is worth too much. “This is one of the best companies in the world with one of the best brands in the world, but it looks like they don’t know how to plan for the future.”

When asked for comment on this story, Disney did not respond.

A game changer or a flop?

According to a 2020 study published in the MIT Sloan Management Review by Christopher Bingham, Bradley Hendricks, Travis Howell, and Kalin Kolev, the stock performance of companies led by “boomerang CEOs” (CEOs who returned to their old jobs) was 10.1% worse than that of companies led by CEOs who had never held the jobs before.

The study found that the main reasons why repeat CEOs didn’t do well were if they were the founders of the company, if they worked in a fast-changing industry, and if the company didn’t do enough to plan for the next CEO.

The study found that Xerox (NASDAQ: XRX) stock dropped 60% in the year after Paul Allaire returned as CEO in 2000 because the company couldn’t adapt to new digital technologies. During A.G. Lafley’s second two-year term as CEO, shares of Procter & Gamble (NYSE: PG) rose about 3%, while the broad S&P 500 index rose about 26%.

Xerox declined to comment, and P&G did not respond to a request for comment.

Bingham said there are reasons to think that bringing Iger back may have been the right choice for Disney.

“There might be more reason to be hopeful than with some of these other boomerang CEOs because Iger wasn’t the founder, wasn’t gone for too long, and is coming back with a plan to help with succession,” he told Reuters in an email.

Steve Jobs, CEO of Apple Inc. (NASDAQ: AAPL), might be the best example of a CEO going back to their old company. Jobs famously took over as CEO of Apple again in 1997, when the company was about to fail, and turned it into the most valuable company in the world by the time he left again in 2011.

Howard Schultz, who founded Starbucks Corp. (NASDAQ: SBUX), did well in his second job as well. Between 2008 and 2017, while he was in charge, shares went up by more than 1,000%.

Starbucks did not say anything about this story, but Schultz’s third term as CEO led to earnings that were better than expected.

“I think this will change everything,” said Stephanie Link, who works at Hightower Advisors as the chief investment strategist and portfolio manager. A link has owned the stock before and thinks it will do well. “This reminds me a lot of Starbucks 2.0 or 3.0 when Howard Schultz came back to work there,” Link said. “I think the only thing [Iger] isn’t very good at is finding someone to take over.”

Related: Disney and other American corporations offer free abortion travel.

Wall Street is happy about Iger’s return, but Disney’s long-term success will depend on whether he can make the company’s streaming business profitable while managing the decline of its traditional television business and a likely slowdown in its parks division if the economy goes into a recession, said David Heger, an analyst at Edward Jones.

Heger said, “Iger may have dodged a bullet because Chapek’s time as CEO was not the best, what with the shutdown of the parks and the end of movie production.” “However, it’s not a good place to be back because there are so many issues in the business and industry as a whole.”