Stocks and the pound get a boost from Britain’s tax cut.

Sydney: On Tuesday, Asian stocks went up after Britain scrapped parts of a controversial plan to cut taxes. This made the global market feel a little better and helped bonds and the pound go up.

Australia’s central bank added to the markets’ sense of relief by raising interest rates by less than expected, by 25 basis points, saying that they had already gone up a lot. This surprised investors.

This made the Aussie dollar go down, the S&P/ASX 200 index go up by 3.6%, and benchmark 3-year bonds have their best day in 13 years.

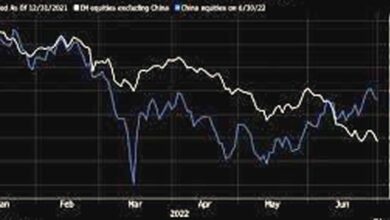

MSCI’s broadest index of Asia-Pacific shares outside of Japan rose 1.7%, led by gains in Australia. Trade was slow because China and Hong Kong were on holiday.

With FTSE futures going up 0.8%, it looked like UK stocks were going to go up.

Geoff Wilson, the head of investments at Sydney’s Wilson Asset Management, said, “It seems a little bit oversold in the short term.”

“Is this all there is? It’s hard to choose the worst, but I don’t think so.” He said this about markets in general.

Japan’s Nikkei rose 2.8%. Sterling went up to a high of $1.1343, which hasn’t been seen in almost two weeks. This is a jump of almost 10% from last week’s record low, which was caused by plans for tax cuts that couldn’t be paid for.

John Briggs, head of economics and markets strategy at NatWest Markets, said, “The about-face won’t have a big effect on the UK economy as a whole.”

But investors took it as a sign that the UK government could and is at least partly willing to change its plans, which have caused so much trouble in the markets in the past week.

Even though the Bank of England bought a small number of emergency bonds, investors took heart from the fact that the long end of the gilt market was stable.

S&P 500 futures (ESc1) went up by 1%. This came after the index went up by 2.6% overnight. [.N]

In a statement, British Finance Minister Kwasi Kwarteng said that tax cuts for high earners would not happen as planned. It was only 2 billion out of the 45 billion planned in unfunded tax cuts that sent the gilt market into a tailspin last week.

Even though North Korea fired a missile over Japan for the first time in five years, the Kospi in South Korea went up 2.5%, moving away from last week’s two-year low. (KS)

STERLING BOUNCE

The pound’s recovery has calmed the currency market a bit, but the strength of the dollar is still keeping a lot of major currencies close to their all-time lows, which is putting Asian governments on edge.

On Monday, the yen reached 145 to the dollar, which was so high that the government had to step in last week. It was the last trade at 144.71. At $0.9838, the euro was about three cents higher than last week, when it hit a 20-year low. [FRX/]

To support the yuan, the Chinese government has done things like send unusually strong signals to the market and take administrative steps that make it more expensive to sell it short.

“More volatility is almost certain as FX markets re-focus on U.S. recession risks, which continue to grow,” said ANZ senior economist Miles Workman, with U.S. jobs data on Friday being the next big data point.

After the central bank meeting, the Aussie dollar fell to $0.6451. Wednesday is the day that the Reserve Bank of New Zealand meets, and the Kiwi stayed just above $0.57. [AUD/]

Overnight, Treasuries went up along with gilts, and the benchmark 10-year yield went down by 15 basis points. In Asia, it stayed the same at 3.62%, after briefly going over 4% last week.

There are many other signs that the market is stressed. The CBOE Volatility Index stays above 30 and at a high level. On Monday, shares and bonds of Credit Suisse hit all-time lows because people were worried about the bank’s plans to restructure.

Oil kept its overnight gains after hearing that production cuts might happen, and Brent futures were up 43 cents to $89.29 a barrel at the last check.