The government’s IT plan and good financial outcomes have aided in halting further deterioration.

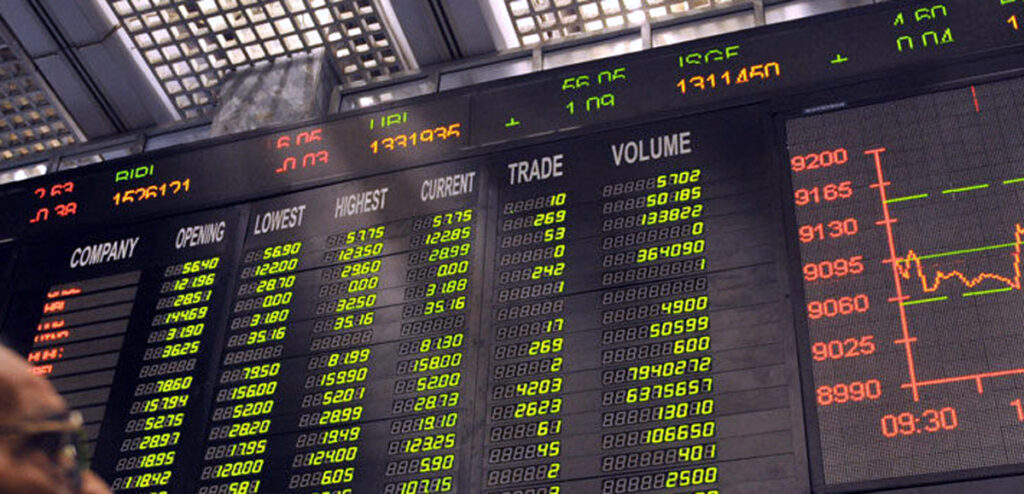

The KSE-100 index fell 1,692 points last week.

“We anticipate range-bound action to continue in the market until the geopolitical dust settles,” AHL forecasts.

KARACHI: The Pakistan Stock Exchange (PSX) continued to be devastated as geopolitical concerns surrounding the Russia-Ukraine crisis escalated; however, the announcement of Rs1 billion in incentives for the IT industry aided in halting a further downward spiral in the stock market.

The KSE-100 index fell 1,692 points, or 3.7 percent, last week to close at 43,984 points.

The week began on a pessimistic note, but the PSX’s worst day this week came on Thursday, when Russia initiated an official involvement in Ukraine. On that one day, the KSE-100 index lost 1,300 points.

Commodity prices were also triggered as a result of the move, with Brent Oil crossing the $100 level.

Additional worries, such as the Financial Action Task Force’s (FATF) decision and a selling binge during the current rollover week, weighed on the index.

“The primary reason for the week’s negative momentum was concern that the State Bank of Pakistan (SBP) could tighten monetary policy in response to increasing commodity prices caused by the Ukraine-Russia crisis,” JS Global analyst Waqas Ghani said.

Additionally, during the week, a high-speed diesel shortage loomed, oil companies warned the government, the Oil and Regulatory Authority (OGRA), Nepra delayed passing on a Rs28 billion additional burden to consumers, Moody’s said that Sukuk and the IMF package would help Pakistan’s economy recover, ZTBL awarded multiple contracts totaling more than Rs450 million to supernet, Special Economic Zones on the Pakistan-Iran border were proposed, and the ECC approved a legal mechanism for bar

Meanwhile, overseas selling totaled $3.2 million this week, up from $1.97 million last week. Cement ($2.1 million) and technology ($1.7 million) were also sold.

Domestically, banks reported the largest purchases ($0.6 million), followed by all other industries ($0.5 million).

The average volume traded during the period under consideration was 299 million shares (up 20% week over week), while the average value exchanged was $38 million (up by 29 percent week-on-week).

The week’s top gainers and losers

Sector-wise, technology and communications (-342 points), commercial banks (-243 points), cement (-222 points), oil and gas exploration businesses (-146 points), and fertiliser (-146 points) all contributed negatively (-127 points).

Whereas industries such as car assembler (+18 points), real estate investment trust (+10 points), and tobacco (+9 points) all contributed favourably.

TRG Pakistan (-201 points), Lucky Cement (-133 points), Systems Limited (-109 points), HBL (-100 points), and Pakistan Petroleum (-100 points) were the main scrip losers (-76 points).

Meanwhile, UBL (+46 points), Millat Tractors (+23 points), and Habib Metropolitan Bank (+16 points) were the top gainers by scrip.

Next week’s forecast

According to a research by Arif Habib Limited, “any de-escalation in Russia-Ukraine hostilities might catalyse a recovery in global markets.” We anticipate range-bound action to dominate in the market until the geopolitical dust settles.”

Market investors are also apprehensive of rising commodity costs, and any hint of a slowdown in oil prices would bolster mood on the local marketplace, it added.

“With the continuing earnings season,” the brokerage firm observed, “certain sectors and stocks are anticipated to remain in the spotlight.”

“The KSE-100 is now selling at a price-earnings ratio of 4.9x (2022), compared to the Asia-Pacific region’s average of 13.5x, while delivering an 8.9 percent dividend yield, compared to the region’s 2.4 percent,” the brokerage firm added.