China’s Ban on Micron Ignites Trade Tensions and Spurs Asian Chip Rally

The recent move by Beijing to prohibit U.S. company Micron Technology Inc (NASDAQ:MU) from selling memory chips to key domestic industries has escalated tensions in the ongoing trade dispute with Washington. This development has also resulted in a surge in the stock prices of companies that could benefit from this ban.

China’s cyberspace regulator announced late on Sunday that Micron, the largest U.S. memory chip manufacturer, had failed its network security review. As a result, operators of critical infrastructure in China would be prohibited from purchasing from the company. However, the specific risks identified or the products that would be affected were not disclosed.

While the action was met with opposition from Washington, it provided a boost to the stocks of Micron’s competitors in China and South Korea. These companies are expected to benefit as Chinese firms seek alternative sources for memory products.

“We firmly oppose restrictions that have no basis in fact,” stated a spokesperson from the U.S. Commerce Department in response to the ban on Sunday. “This action, along with recent raids and targeting of other American firms, is inconsistent with (China’s) assertions that it is opening its markets and committed to a transparent regulatory framework.”

Tensions between the United States and China have escalated in recent months due to raids conducted by Chinese authorities at U.S. corporate due diligence firm Mintz Group and management consultancy Bain. Micron confirmed on Sunday that it had received the regulator’s review and expressed its willingness to engage in further discussions with Chinese authorities.

This move makes Micron the first U.S. chipmaker to be targeted by Beijing following a series of export controls imposed by Washington on certain American components and chipmaking tools to prevent their use in advancing China’s military capabilities.

China initiated the review in late March amid a dispute over chip technology and worsening relations between the two countries. It also comes shortly after the Group of Seven nations agreed to “de-risk, not decouple” economic engagement with China, and as U.S. President Joe Biden called for an “open hotline” between Washington and Beijing.

The U.S. Commerce Department stated that it would directly communicate with authorities in Beijing to seek clarification on their actions. Additionally, it intends to collaborate closely with key allies and partners to address market distortions caused by China’s actions in the memory chip market.

The impact of China’s announcement regarding the Micron review was evident as shares of local chipmaking-related firms surged on Monday, with state media reporting potential benefits for domestic players. Companies such as Gigadevice Semiconductors, Ingenic Semiconductor, and Shenzhen Kaifa Technology saw their shares rise between 3% and 8%.

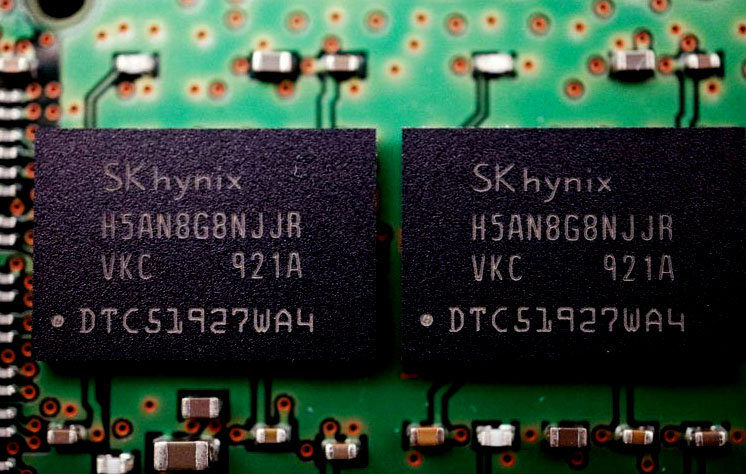

Major competitors of Micron also experienced stock gains, with South Korea’s Samsung Electronics (OTC:SSNLF) and SK Hynix rising by 0.7% and 2% respectively, compared to a broader market increase of 0.9%.

According to analysts at Bernstein, as China’s domestic memory suppliers lack competitiveness in terms of technology and capacity, the country would need to turn to alternatives such as Samsung (KS:005930), SK Hynix, Kioxia, Western Digital (NASDAQ:WDC), or other foreign suppliers instead of Micron. The analysts noted that Samsung and SK Hynix, which have chip factories in China, may gain greater traction with Chinese customers. However, both companies declined to comment.

On the other hand, Jefferies analysts predict that the impact on Micron will be limited since its major customers in China are consumer electronics firms rather than infrastructure suppliers. They believe that Micron’s revenue from China, which accounted for 16% of its total revenue last year, is primarily generated from smartphone and computer manufacturers, not telecommunication companies