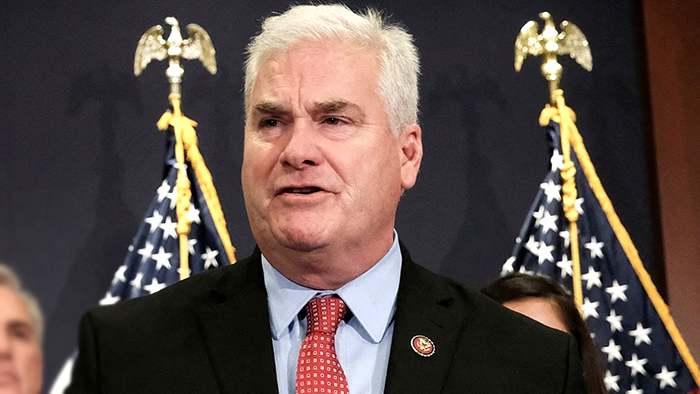

In the wake of the FTX crash, a congressman who likes crypto, Tom Emmer, is thinking about bringing back a bipartisan bill that would remove the need for some crypto businesses and projects to register as Virtual Asset Service Providers (VASPs).

Emmer, a Republican, and Darren Soto, a Democrat, were in charge of the “Blockchain Regulatory Certainty Act.” It was first brought up at the 117th Congress on August 17, 2021, but it didn’t go any further.

It’s probably a good time to bring back my bipartisan Blockchain Regulatory Certainty Act.

Related: A US senator demands answers from Gensler of the SEC on “regulatory failings.”

The bill says that entities on the blockchain that never hold customer money are not money transmitters, giving crypto the legal certainty it needs to grow in a way that fits with American values.

— Tom Emmer (@RepTomEmmer) December 14, 2022

Emmer may feel better about his chances this time around, since the U.S. government is working hard to get regulations in place to prevent another FTX-style disaster.

Emmer said in a tweet on December 15 that it’s “probably a good time” to bring the bill back up. He also said:

“The bill says that blockchain entities that never hold customer funds are not money transmitters. This gives the legal certainty needed to make sure that the future of crypto reflects American values.

The goal of the bill itself is to set up rules that make it easier for “blockchain developers and service providers” like miners, multi-signature service providers, and decentralised finance (DeFi) platforms to do their jobs without having to deal with certain problems or meet certain requirements.

It was made in response to draught guidance from the Financial Action Task Force (FATF) in June 2021 that wanted to expand the definition of virtual asset services providers (VASPs) to include “any provider that can develop or operate a DeFi platform, even if they don’t interact with users.”

During the House Financial Services Committee hearing this week, Emmer praised the crypto community for using blockchain technology to find out key information about the company’s operations. This is in contrast to a number of U.S. politicians who have used the FTX collapse to attack crypto.

Bills, bills, and more bills

On the other end of the political spectrum, Senator Elizabeth Warren, who doesn’t believe in cryptocurrencies, and Senator Roger Marshall introduced the Digital Asset Anti-Money Laundering Act of 2022 on December 14.

The main goal of the bill is to stop banks from using privacy tools like crypto mixers and to require crypto firms to follow the same money-laundering rules as banks. The bill also wants to regulate crypto kiosks (ATMs).

KYC controls would also have to be put in place by miners, custodial wallet providers, and self-custodial wallet providers.

Senator Cynthia Lummis, who is known to hold Bitcoin and support it, has criticised the bill, saying that KYC requirements won’t work with crypto.

requiring open source developers to add AML/KYC to node software and hardware wallets? This dog won’t go hunting.

Related: Musk sells more Tesla stock, this time for $3.6 billion.

Cynthia Lummis (@CynthiaMLummis) December 14, 2022

On December 14, Lummis said that she plans to reintroduce a bill that would give most of the power over cryptocurrency to the Commodity Futures Trading Commission (CFTC) instead of the Securities and Exchange Commission, as Warren and others are pushing for.