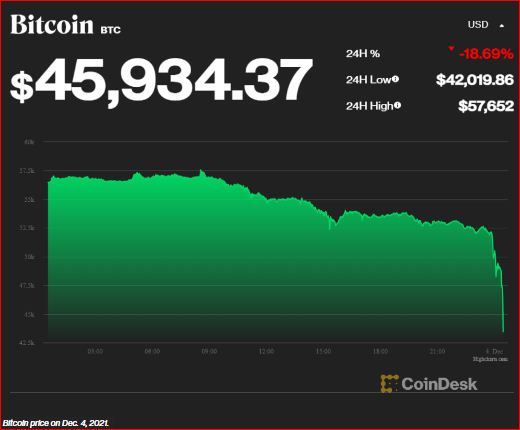

Bitcoin prices dropped on Saturday morning, falling nearly $ 10,000 about an hour to a low while $ 42,000 before bouncing up to $ 45,000.

Bitcoin has fallen around $ 15,000 for the past 24 hours. Ether, the second largest cryptocurrency by market capitalization, down around $ 1,100 over the same period of time.

The leading cryptocurrency reflects a wider decline in crypto market, according to the Coindesk price index, with several cryptocurrency falls more than 20% over the past 24 hours. Most of these assets seem to have experienced a sharp decline starting at 04:00 UTC on Saturday.

According to Coingecko, the overall market limit is currently floating around $ 2 trillion.

Spot market sales seem to have pushed the lower cryptocurrency before triggering a large stop loss in the derivative market.

“So far I have looked up to 4000 BTC sold that pushed the market suddenly fell,” Laurent KSIS, a fund expert traded on the Exchange and Director of CEC Capital. “In fact, 1,500 BTCs only sell in less than a minute at fall.”

The data tracked by the coinglass shows a decrease in prices has triggered the position of Bitcoin Bitcoin worth $ 600 million in less than an hour. The market appeared more than the leverage earlier this week with open interest (OI) increased in the term bitcoin.

“Oi rebominated Bitcoin now remains above 365,000 BTC for more than a month. It is not common to see high OI which is supported for so long duration. It can show that the market is currently excessive with the leverage,” Arcane weekly weekly record published Tuesday.

Tether, the largest stablecoin in the world with market value, see a short surge to $ 1.025 on the exchange of coins registered by Nasdaq, moved from the normal pegs 1: 1.

During a sharp decline in prices, traders usually treat Tether as a safe place, given the value is pegged in the US dollar, traditional market risk assets.

The accident to the lowest since late September was present after uncertainty caused by Omicron variants of Covid-19 and Federal Reserve (Fed) discomfort with high inflation. On Tuesday, Fed Chairman Jerome Powell retired temporary words from the inflation discussion and said that the central bank could consider

Even so, some use this fall as an opportunity to “buy a dip.” El Salvador President Nayib Bukele, whose country holds Bitcoin on the balance sheet and has bought coins during the previous decline, announcing the purchase of 150 BTC each for around $ 48,700 each.