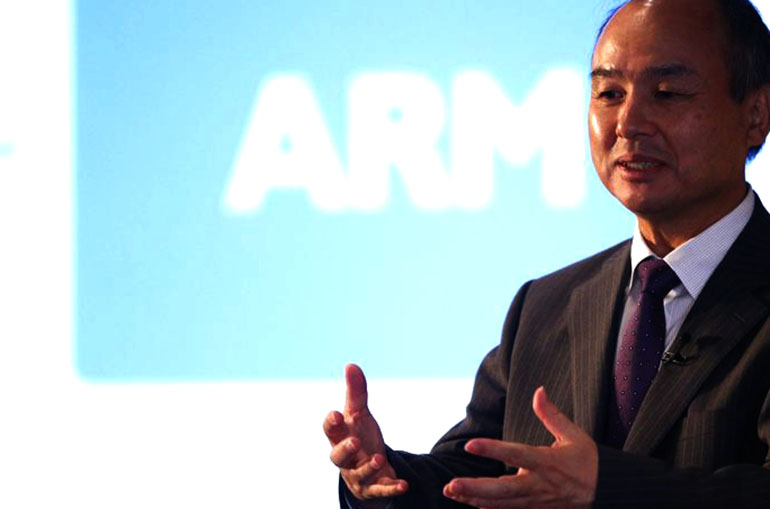

Tokyo (Reuters) -Masayoshi Son, the founder and CEO of SoftBank Group Corp, said again on Friday that the Japanese conglomerate was most likely going to list the British chip design unit Arm on Nasdaq, but that no decision had been made yet.

Son told shareholders at the company’s annual general meeting that most of Arm’s clients are in Silicon Valley and that U.S. stock markets would love to have Arm.

Son also said that there were requests to list Arm in London, but he did not say where these requests came from. The business owner didn’t say if the conglomerate is thinking about putting Arm on a secondary stock exchange there.

The billionaire spent most of his speech talking about Arm’s business prospects. After a deal to sell to Nvidia fell through, the company changed direction and is now focusing on going public (NASDAQ: NVDA).

Before SoftBank bought the Cambridge-based company for $32 billion in 2016, it was on the stock market in both Britain and the United States.

SoftBank gets a lot of its money from Arm. It has borrowed $8 billion against the unit’s shares and used shares in Chinese e-commerce giant Alibaba (NYSE: BABA) Group Holding Ltd in prepaid forward contracts to get a total of $13.2 billion.

Son is under pressure from his shareholders because the prices of the high-growth stocks he likes to invest in are going down and interest rates are going up. In May, SoftBank’s Vision Fund unit reported a record loss.

Since SoftBank’s AGM last year, the price of its shares has dropped by about a third. Son asked shareholders to think about the company’s future.

Son said, quoting a Japanese proverb, “Peaches and chestnuts take three years, persimmons take eight years, and even fruit takes that long.” “If you wait five to ten years, I’m sure you’ll get something tasty.”

More than 40 years after he started the company, Son said he was still fit to be one of Japan’s most important business leaders. He joked that even though he can’t drive the ball as far on the golf course as he used to, he’s still not losing games.

The 64-year-old told shareholders, “I’m still full of energy, confidence, and dreams.”

Son said, “It’s just my hair that’s going back.”