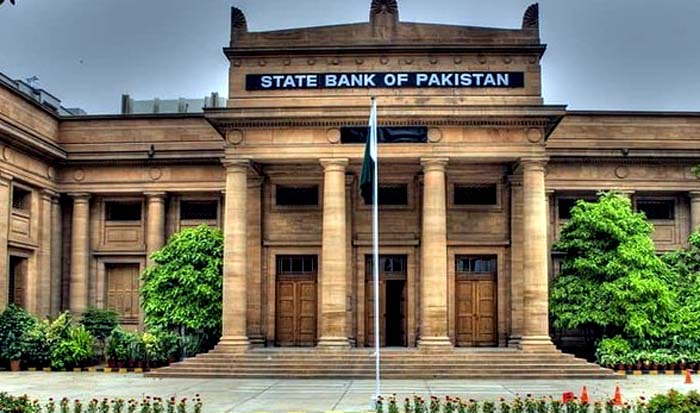

In order to meet the demand for agricultural loans in the country, Bank Daulat Pakistan has set a goal for FY23 of giving financial institutions Rs 1.8 trillion in agricultural loans each year.

In addition, production loans of 140 billion rupees for the wheat crop and 45 billion rupees for financing tractors, harvesters, planters, and other farm machinery would be provided in accordance with the fiscal year’s overall objective in order to satisfy national food security and installation demands. Specific funding goals of 20 billion rupees have been established.

The State Bank has also raised the nominal credit limits per acre for agricultural financing. This is to help farmers get enough bank loans and get the most out of their crops.

The token credit limit for wheat has been raised from Rs 60,000 to Rs 100,000 so that there is enough food for everyone. This will allow farmers to use higher-quality inputs to get better yields.

During the 22nd fiscal year, 1,419 billion rupees were given to the agriculture sector by financial institutions.During FY21, however, Rs 1,366 billion was disbursed, but outstanding agricultural loans increased by more than 10%.

One of the most important things the State Bank has done recently is to create a comprehensive agricultural credit scoring model. This is part of an effort to improve the quality and geographic spread of agricultural loans in the country.

Recent growth in the supply of agricultural credit has been slow because of problems like the negative effects of climate change, a lack of bank resources, and borrowers who don’t use approved loans.