Emerging market funds get a lot of money in January because China is back in business.

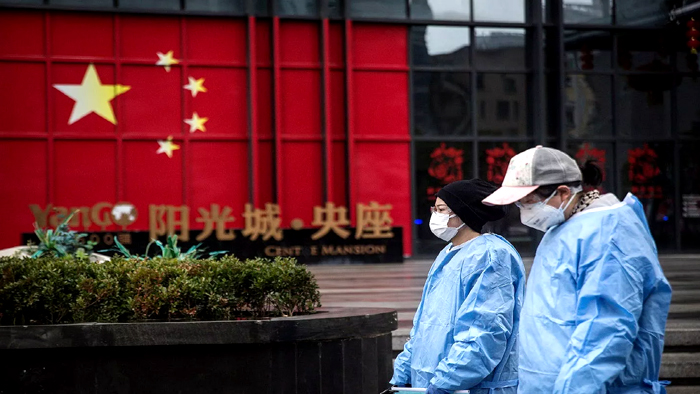

After a dry spell last year, investors poured a lot of money into bond and stock funds for emerging markets in January. This was helped by China’s reopening and a drop in inflation pressures around the world.

Refinitiv Lipper data, which covers more than 33,700 emerging market (EM) funds, shows that in January, EM equity funds got $13.2 billion and EM bond funds got $11.36 billion. Both of the new funds coming in were the most in over a year.

Fingfx.thomsonreuters.com/gfx/mkt/jnpwyxlawpw/Fund Flows.html EM stocks and bonds

In 2022, there was a net outflow of $26.26 billion from EM bond funds as a whole.

Related: U.S. businesses are preparing for emergencies in Taiwan despite the tensions with China.

Analysts think that EM assets will do better this year thanks to lower valuations, a weakening dollar, Fed rates reaching their peak, and lower U.S. Treasury yields.

The MSCI Emerging Markets and World Index’s PE https://fingfx.thomsonreuters.com/gfx/mkt/lgpdknxoavo/MSCI%20Emerging%20Markets%20and%20World%20Indexs%20PE.jpg

“Even though global growth is slowing, we think EM equity valuations have room to improve in 2023,” said Josh Rubin, portfolio manager at Thornburg Investment Management. This is because of lower inflation, a peaking U.S. dollar, more clarity about key political events, and structural changes in the region.

Taiwan and Korea should do better if the semiconductor and hardware technology industries get better. Brazil could be the first big EM outside of China to start easing next year.

According to data from Refinitiv, emerging market firms are expected to grow their profits by 11.9% in 2023. This is much higher than the 8.9% growth of U.S. firms and the -2.2% growth of European firms.

In January, the iShares Core MSCI Emerging Markets ETF and the iShares JPMorgan (NYSE:JPM) USD Emerging Markets Bond ETF got $3.2 billion and $2.4 billion, respectively. The iShares MSCI Emerging Markets ETF (NYSE:EEM) and the BlackRock (NYSE:BLK) Emerging Markets Fund each got over $1 billion.

The amount of money invested in EM funds in January 2023 is available at https://fingfx.thomsonreuters.com/gfx/mkt/akpeqmnoopr/Biggest%20EmFunds%20in%202019.

The MSCI Emerging Markets index is up about 6% this year, but it still trades at a 22% discount to the MSCI World index for the next 12 months.

The JP Morgan EMBI + index, which follows liquid, US dollar-denominated fixed-rate and floating-rate debt instruments issued by sovereign entities in emerging markets, has gone up by 3.34 percent this year after falling by about 25 percent last year.

UBS said in a note, “We see value in EM sovereign bonds, especially in some of the larger sovereign issuers that can work with the IMF or other international lenders, or where we see upside to potential restructuring scenarios.”

Jason Pang, a fixed-income portfolio manager at J.P. Morgan Asset Management, said he is bullish on Indonesian and Malaysian government bonds because their central banks are looking to ease up on monetary tightening because inflation pressures are falling.

But some people wonder if the rise in emerging assets will last. The initial excitement about China reopening has died down, and EM assets have seen small drops in February.

Komson Silapachai, vice president at Sage Advisory Services, said, “Given the strong start to the year, we think the bar is high for a continued rally in EM at the pace of the last two months, given that China reopening and the Fed slowing down are mostly known quantities at this point.”

Related: U.S.-China tensions and Fed worries hurt Asian stocks.

“EM risk assets would not be safe if the markets started to price in a higher chance of a recession.”